At the PostTrade 360 conference in Stockholm on 6–7 March, local Johan Toll – Nasdaq’s global head of digital assets – will be presenting his eyebrow-raising Singaporean blockchain project. We had a chat with him.

Ubin is the name of the project where Nasdaq Technology, whose global organisation is based in Stockholm, has provided the technology platform to support a proof-of-concept solution for the Singapore Exchange and Monetary Authority of Singapore. It will be presented as part of the program of PostTrade 360 Stockholm on 6–7 March.

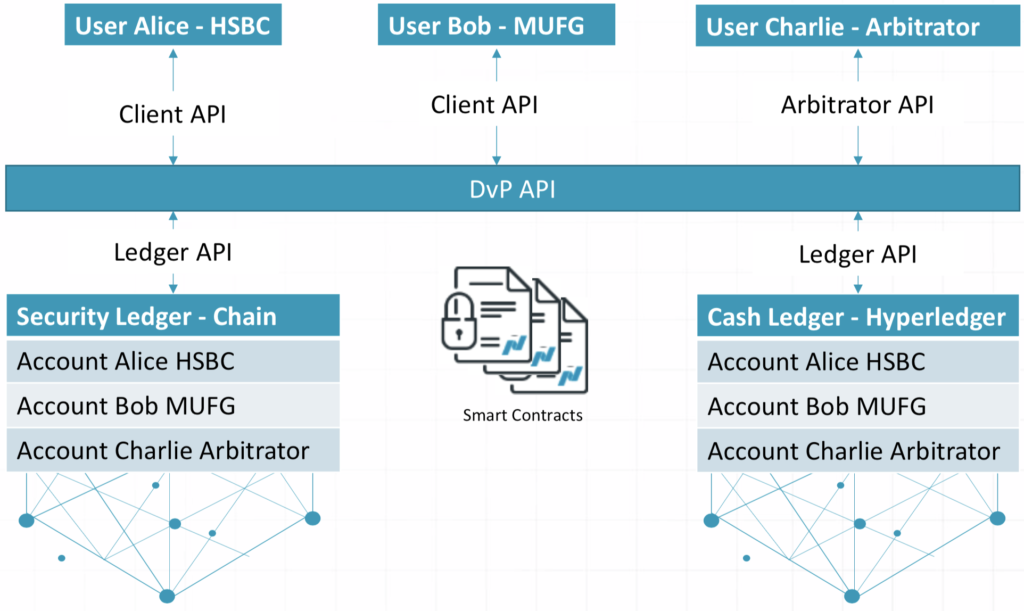

The solution enables the delivery of assets versus payment that reside on different blockchain platforms. In the project performed, these assets are central bank-issued digital Singapore dollars on one blockchain platform, being exchanged for government debt obligations that live on another blockchain platform, in a delivery-versus-payment process (DvP).

Conceptually, the solution could be applied for building business processes integrating virtually any kind of assets based on various blockchains, enabling them to be exchanged.

Briefly summed up, what is the project about?

”The question we wanted to answer could be put this way: ‘In case we enter a world where our industry is blockchain based – how do we solve the DvP challenge in a faster and more efficient way?’,” says Johan Toll.

”Today we see various blockchain pilots and networks appearing, to manage different assets. What we have helped the Singapore Exchange and the Monetary Authority of Singapore to do, is investigating how the logic of ”smart contracts” can be used to guarantee that the delivery of an asset takes place against a money payment on a different network. Ensuring this costs a lot today, in time, risk and money.”

”We also see that for the cases where it goes wrong, for example when a buyer is unable to present the cash on time, there needs to be room for an arbitrator to step in and resolve a conflict. We have made it possible to get that arbitrator role into the contract terms from the start.”

”For you personally, what has been most rewarding about this work?”

”It has been incredible to work globally, near our long-term partners at the Singapore Exchange, and the MAS which is also a great fintech actor. It is exciting to see that we are getting to grips with the challenge – being able to guarantee clearing and settlement in networks based on these blockchains when they start flying.”

”The Singaporean actors in this project, like yourselves, seem to be early movers in a global comparison – and it appears that people from other parts of the world are glancing at what you have done. Could you tell us something about the attention you are receiving?”

”We have had plenty of responses from Nasdaq Technology’s own clients across the world. They see that this is spot-on what will be needed in the future. It goes for marketplaces, not least, but also central banks. And many people download the public industry report on the project. It is very well written.”

For yourself – what takeaways do you hope to be able to bring home with you from the PostTrade 360 conference?

”It will be nice to meet many others from the industry. And blockchain technology – being a dear topic to me personally – is inherently made for collaboration. You don’t build a blockchain network to sit and use on your own. I had a part in initiating the Nordic Fund Ledger project together with SEB, and it now has its own organization. Then, of course, we are on constant outlook for new projects.”

Connects existing DLT networks

Technically speaking, the platform built for the Singapore project is not a DLT solution in itself. Rather, it is a platform which plugs into the interfaces of the different blockchain networks where the different assets reside.

The exchange is then controlled on this combining platform, not necessarily very different from how it would be managed if it were connecting to traditional non-DLT databases.

By coordinating connections not only with different asset databases, but also with asset managers and other stakeholders on different platforms, this type of solution could enable a broad range of new business processes. Preparing for the arbitrator roles is one way of supporting this. Naturally, this type of solution is expected to grow from the core of the financial post-trade industry. Yet future applications could be a lot broader. As a possible example from everyday life, Johan Toll foresees that a similar system could be used for exchange of digital concert tickets between individuals.