Still trying to get a grip on what is going on in the finance space when it comes to digital ledger technology (DLT)? This senior panel at the recent Ethereum in the Enterprise conference may help map the landscape.

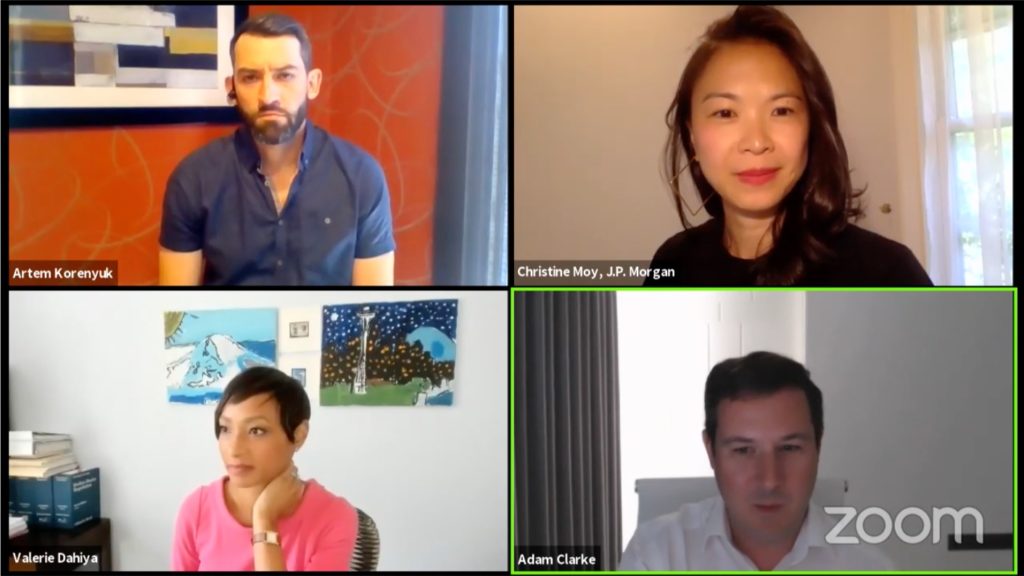

Could DLT cut transaction costs around private securities? Well, according to Artem Korenyuk, head of business innovation and fintech strategy at DTCC, his organisation is betting on it. The half-hour “Ethereum in finance” panel within the Ethereum in the Enterprise conference last week saw him describing the rationale for Project Whitney (which we have previously written about here). As the United States CSD, DTCC sees the main part of its operations in the public securities space – where participants’ transaction costs are low. DLT is presenting an opportunity for radical change in the private securities sphere.

Chief Technology Officer Adam Clarke represented Fnality – an initiative to broaden companies’ access to central bank money. As of today, such money will rest on balance sheets of big banks, where owners’ payments can take days to settle. With the distributed access that DLT enables, the nature of payments and money could change.

On the panel was also Valerie Dahiya, legal consultant with Perkins Coie, summing up the questions her company’s clients are currently working to answer.

The session was paved with a five-minute introduction by its moderator, JP Morgan’s blockchain lead Christine Moy, who went through the many phases of development only in the last six or seven years. JP Morgan is working on JPM Coin – blockchain-based tokens for money that clients hold with the bank on a commercial-banking basis, thus different from the central-bank money which Fnality is about.

A video of the conference has been posted on Youtube, difficult to navigate as there is little meta-info. Let us assist you with these direct links to pieces of the finance panel:

Introduction, five minutes with JP Morgan’s Christine Moy:

Link to video section here

Valerie Dahiyas of Perkins Coie, on how her clients navigate the regulatory regime:

Link to video section here

Adam Clarke, Fnality, on the creation of a new payment system without counterparty risk:

Link to video section here

A funny discussion on the distinction between the money formats of Fnality’s and JP Morgan’s JPM Coin solutions:

Link to video section here

Artem Korenyuk, DTCC, discusses his company’s venture into DLT both to modernise the existing main business (in Project Ion) and to explore the new area of private securities (in Project Whitney):

Link to video section here

Ethereum is a public blockchain platform favoured by many enterprises, as a foundation for running their own business applications on in turn. A feature that many find valuable is that execution of contracts can be automated.