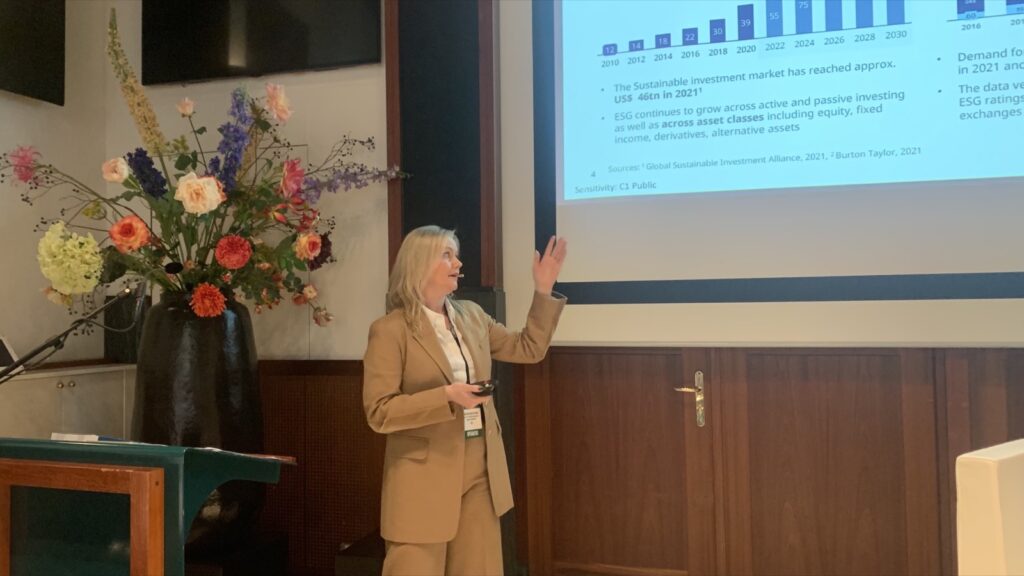

[VIDEO] The structured effort that financial institutions must put in to make use of sustainability data – which is increasingly mandatory – was spotlit as Martina Macpherson mapped the ESG data landscape at PostTrade 360° Amsterdam.

The session was sponsored by SIX.

Different sustainability labels will prescribe different exclusions from your portfolio. So when several labels are piled on top of each other, the overlaps may reduce a portfolio manager’s selection of potential investment targets to the level where it gets harder to hit targets.

With a background as a pioneering practitioner in investments ESG, as well as a writer and scholar, Martina Macpherson has grown a strong following as an influencer in the area. Since June, she is the Head of ESG Product Management for SIX – responsible for product strategy, management and go-to-market for the company’s data and analytics ESG / SDG product offering.

Financial institutions can have different reasons for approaching their ESG data challenges, and solutions should be designed accordingly. It could relate to “reg-risk” management, to use of ESG data and services, or for ESG analytics. In either case, Martina Macpherson sees a need for systematic solutions on a level that most have not had in place earlier. Those Excel sheets just won’t cut it.

“We cannot actually separate sustainability from technology and innovation.”

• News around PostTrade 360° Amsterdam 2022, on 10 November, is gathered here.

• The conference info site, with detailed agenda, is here.

• By the way … are we connected on LinkedIn already, among the 2,600 post-trade pros who are? Follow us here.