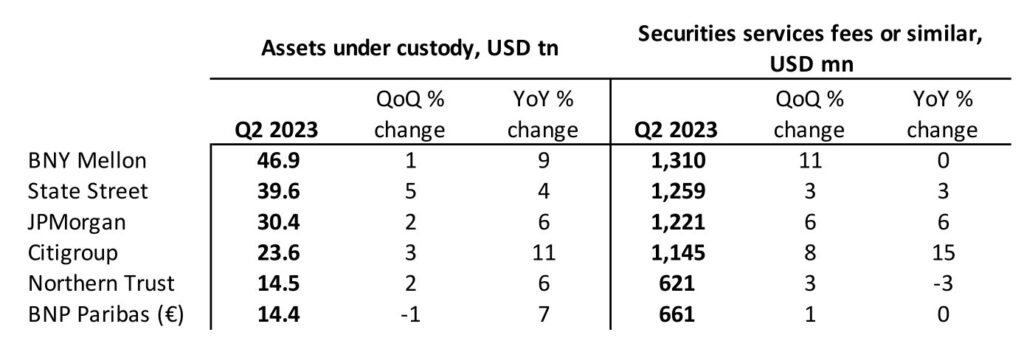

With the month of June firmly behind us, quarterly financial reports for five of the six largest global custody banks are in. Numbers show that the days of double digit percentage increases in assets under custody (AUC), seen in Q3 and Q4 2021 and at the end of 2020, have not returned, but the market appears to be out of the doldrums of negative growth that dominated reports last year.

[This article was updated on 28 July with the reported figures for BNP Paribas.]

What has not changed from last year are the high interest rates – and its continued benefit to the custodians. BNY Mellon states that the YoY increase in revenue from asset servicing “reflects higher net interest revenue, partially offset by lower foreign exchange revenue” while the YoY increase in revenue from issuer services “reflects higher net interest revenue and depositary receipts revenue”.

Note that the numbers shown in the table may not be perfectly comparable due to differences in the scopes represented by the figures. For example, AUC figures from some firms also include assets under administration (AUA). This year, we are applying an income figure for Northern Trust that is significantly narrowed down compared to earlier. The table now includes only figures from the “Total Asset Servicing” line in Northern Trust’s report under “Trust, Investment and Other Servicing Fees”, after having included also the ones from the wealth management field in our previous coverage. Don’t hesitate to follow the links to the sources if the details are important to you.

A strong showing

State Street enjoyed a strong quarter for AUC, with the strongest QoQ growth of 5.32 percent. Year-on-year, the Boston-based custodian’s 3.66-percent AUC/A growth was said to be driven primarily by “higher quarter-end equity market levels and client flows”. This has not translated into financial benefit for the bank – its QoQ revenue growth for securities services is the weakest at 3.45 percent. Its YoY securities services revenue even saw negative growth of 2.93 percent. State Street attributes the decrease to net new business being more than offset by lower client activity or adjustments and below average pricing headwinds.

Ron O’Hanley, State Street’s chairman and CEO says, “Our second-quarter results reflect the strength of our business model YoY as strong net interest income growth, a significant expansion in front office solutions and higher securities finance revenue contributed to improved EPS and ROE. Quarter-over-quarter we saw good fee momentum across a number of our businesses, helped by accelerated onboarding of our to-be-installed AUC/A pipeline, while we continued to invest and serve our clients.”

Reaping rewards

Year-on-year, the strongest performer is Citigroup, with an 11.32 percent AUC growth. Unlike State Street, it is reaping rewards for this growth–the YoY increase in its revenue from securities services is the highest at 15.19 percent. The firm reveals in the report that its net interest income increased an impressive 62 percent following a strong drive by higher interest rates across currencies.

JPMorgan’s securities services revenue was USD 1.2 billion, up 6 percent. The bank states that this was “driven by higher rates, largely offset by lower fees and deposit balances”.

Not all numbers are in, so watch this page for updates.