COLUMN – OLAF RANSOME | Real-time reconciliation will make your life a whole lot easier. No contradiction intended. Yes, operations work is all about reconciliation. Here’s how to get excited about it – and move away from it being a boring routine.

In a series of six column contributions with PostTrade 360° throughout 2024, banking operations veteran Olaf Ransome digs into the topic of operational resilience – to help us understand its meaning under changing rules, and get adequately prepared. Find his articles listed here.

A recent conversation with a great ops manager at a new hedge fund inspired this month’s thinking.

For a hedge fund, whether you are booking 300 trades a day or 3,000, control is about reconciling between your counterparties and to your books and records along with any additional support systems, doing that in real-time and resolving any discrepancies the same day.

Operations is all about reconciliations. There are necessarily various systems which keep a record of transactions made. From front-office to back-office to external custodians, correspondent banks and in some cases Central Securities Depositories (CSDs) and central counterparties (CCPs).

In the world of hedge funds, there is the added complexity of having a fund administrator, often coupled with outsourced operations. The best run hedge funds have a mantra of “no breaks at the end of the day”. Think of that claim from the perspective of an investor, if you know there are no breaks then the NAV (Net Asset Value) which the fund is reporting is going to be accurate. You can’t say that if there are breaks, i.e. discrepancies, between the various parts of the system.

To give a sense of “what good looks like”, I’d like to share some thoughts from an industry veteran. Greg Burnes has been in the financial services business for more than 35 years. Right now, he is helping set up a new hedge fund in the US. Before that he was Head of Operations for a $6 billion global macro fund and back in time the Director of Fixed Income Americas Operations at Credit Suisse First Boston (RIP).

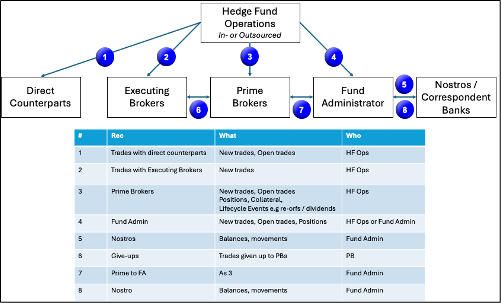

No breaks at the end of the day means that all reconciliations are done intra-day, with breaks or differences resolved as they are found. Figure 1 shows the typical scope of recs needed. There may be others; the point is that if you have these done and differences fixed, your valuations are right, and your positions are accurate; that gives confidence to both a fund’s traders and all the investors.

Figure 1: Typical Reconciliations Scope[1]

Of note is that if you have the capabilities to achieve the no breaks at the end of the day nirvana, you have a lot of positives:

From control comes …

Capacity: if you are busy chasing yesterday’s differences, you are not focusing on today; that drains resources and distracts. And, you have the resource to deal with any abnormal situations today.

Confidence: you are pretty sure the numbers are right. The business can make well informed decisions. And, if you are a hedge fund, the ability to show control will be a significant driver of a successful operational due diligence review with potential investors.

Cost: you are producing at the lowest possible unit price. That translates to great returns for investors.

Compliance: You will be very popular with your auditors. This is not a trivial thing; no breaks mean less time to verify the audit. More capacity for you. The same goes for regulators. If you can clearly demonstrate your controls, then they will demand less of your time. More capacity, again.

In thinking about resilience, I would make the case that as our regulators and others ask more questions about resilience, we can make a huge contribution toward giving both the regulators and all the other stakeholders confidence by following this same-day, zero breaks culture.

As an aside, in the world of digital assets, there is a lot of talk about how the use of DLT (distributed ledger technology) will eliminate reconciliations. Practically, shared ledgers will help, but one fundamental will remain. Financial services firms will need to be able to show how their internal ledgers, their books and records, match an external statement. Otherwise known as the “ledger to statement rec”. Now the external statement may well come from a DLT system, but that does not negate the need for that check.

With the shift to T+1 and eventually T+0, the standard of perfect information everyday will become a reality across the financial services industry.

[1] Thanks to Michael Van Zanten at Cura & Senectus Investment, and Christian Marshall, formerly of Brevan Howard & Coremont, for their valuable input.

Referring to himself as The Bankers’ Plumber, Olaf Ransome is founder of 3C Advisory LLC – drawing on decades of senior operational experience from large banks. To connect, find his LinkedIn page here.