Dai Yamashita, Post-Trade Quantitative Research & Development Manager at OSTTRA, guides us through the dynamic landscape of XVA, focusing on key themes that currently resonate within the company’s customer base.

Archegos crisis and recognition of the importance of XVA

In recent years, significant loss incidents such as the Archegos crisis have fuelled growing interest in XVA among various financial institutions. Notably, the function of XVA desks and their role in counterparty risk management has become increasingly vital.

For accounting purposes, mid-sized financial institutions have been required to implement CVA by regulators and auditors. The introduction of CVA into accounting has increased the interest of management and created pressure to consider CVA in pricing and risk management. We are aware of the increasing need for calculations in Front Office and Risk Management at those institutions, such as CVA sensitivity calculations and pre-deal CVA simulations.

Through the market-leading collateral management platforms OSTTRA triResolve and triResolve Margin, we have observed that a wide range of financial institutions are becoming increasingly aware of the significance of CSA terms for CVA in collateralised trades.

SA-CCR and KVA

Financial institutions, including non-G-SIB regional banks, that have established XVA desks are actively managing XVA according to their business characteristics. For example, the migration from CEM to SA-CCR could motivate a wide range of banks to start managing KVA based on SA-CCR to prepare for the increased capital cost on short-term transactions.

From a macro perspective, CVA has long been a concern for authorities due to the adverse selection problem, where the systemic risk arises from CVA-unfavourable trades being concentrated in financial institutions lacking proper CVA management. A similar mechanism applies to KVA as well. There is a risk that transactions unfavourable in terms of cost of capital may become concentrated in institutions that do not actively manage KVA, leading to a widening gap in capital cost performance. Consequently, we anticipate that KVA will increasingly become a growing concern for an even broader range of financial institutions in the future.

Benchmark Reform and FVA

Benchmark Reform, including the finalisation of the LIBOR part in June 2023, could also have implications for XVA. If the LIBOR discount was previously applied to uncollateralised trades before the Benchmark Reform, the application of the OIS discount as a result of the Benchmark Reform will lead to a smaller difference in the valuation treatment between uncollateralised and collateralised trades. This has increased the importance for a wide range of financial institutions to properly consider the funding costs/benefits of uncollateralised trades through FVA.

Basel III

Regarding the finalisation of Basel III, SA-CVA is likely to be a significant topic of discussion. While there may be reasonable hurdles, such as the need to establish a CVA desk and obtain approval from authorities, it is expected to be more effective in reducing RWAs by hedging credit risk using a proxy or hedging market risk. Moreover, the impact of collateral can be directly considered in the exposure simulation, further enhancing the effectiveness of reduction efforts. This presents an excellent opportunity for financial institutions to begin managing CVA within the CVA desk framework.

As an example, the OSTTRA triCalculate XVA engine not only supports XVA sensitivities but is also optimised for performance using GPU utilisation, thus overcoming performance challenges. With this capability, OSTTRA aims to assist financial institutions seeking to reduce RWAs through SA-CVA in the future.

UMR, MVA and collateral modelling

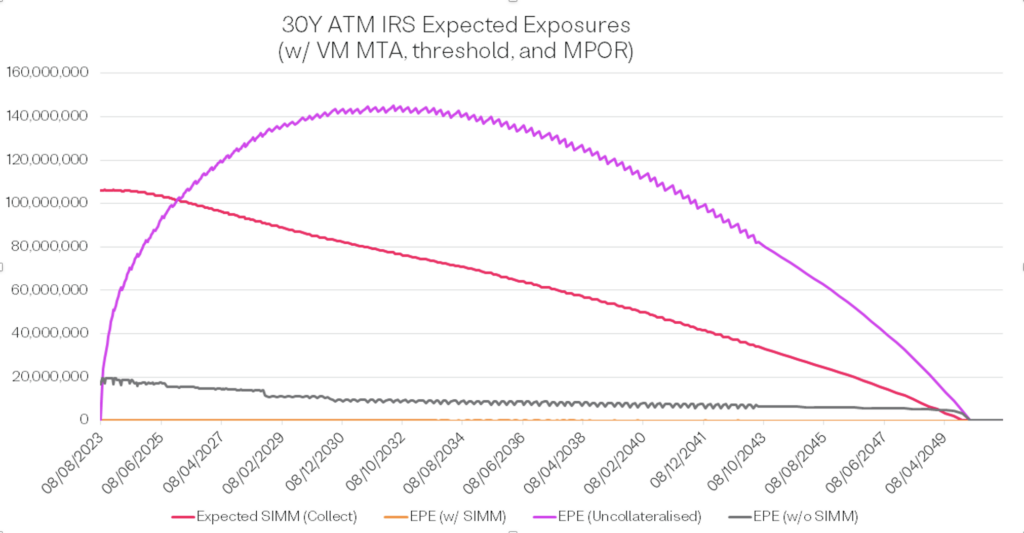

Another recent regulatory change is the implementation of Phase 6 of the UMR in September 2022. Alongside the initiation of Phase 5 in 2021, a significant number of financial institutions worldwide have come under IM regulations, making IM exchange for interbank transactions even more common. From an XVA perspective, it now becomes more essential to consider the impact of future IM in both CVA and MVA calculations.

Depending on the calculation approach, this may involve computing SIMM sensitivities at future simulation dates, which can be computationally intensive and equivalent to MVA in terms of complexity. However, OSTTRA triCalculate provides a SIMM calculation engine alongside the XVA engine, which has been widely adopted by many financial institutions globally. This means it can effectively leverage the SIMM engine to perform accurate and up-to-date SIMM computations in MVA/CVA calculations. This ensures a comprehensive and robust assessment of the implications of future IM in XVA considerations.

Furthermore, in response to the evolution of IM regulations, there has been a standardisation of margin conventions that consider both IM and VM IA (Independent Amount). As a comprehensive provider of collateral management-related platforms, OSTTRA remains constantly updated with the latest developments in these areas and incorporates them into XVA calculations as required.

Regarding collateral treatment, although there has been a general trend preferring “clean CSA”, where cash collateral is posted in the currency of the underlying trade, there is still considerable demand for handling various types of collateral posting. As a response to client needs, OSTTRA triCalculate has recently enhanced its collateral handling capabilities and upgraded the ColVA calculation accordingly, ensuring flexibility and adaptability to different collateral requirements.

User-friendly and holistic calculation service by OSTTRA

From our perspective as a provider of XVA calculation services, we understand the increasing benefits of performing various derivatives-related calculations in an integrated manner. The ability to conduct multiple calculations from a unified interface, efficiently and cohesively, brings significant advantages. For example, performing SIMM calculations at future simulation dates within MVA/CVA computations or addressing the need for SA-CCR calculation in CCR KVA using the same interface as the spot SIMM/SA-CCR calculations proves highly advantageous.

We aim to meet the varied calculation requirements of our clients through a comprehensive approach. By considering this aspect and focusing on usability optimisation, we strive to offer a solution that streamlines the process and enhances overall performance. Our goal is to provide a user-friendly and effective platform that caters to the evolving needs of our clients in the realm of derivatives-related calculations.

To find out more, contact our team of XVA Calculation experts.

This article is for information only. OSTTRA Group Ltd and its subsidiaries including TriOptima AB (“OSTTRA”) makes no warranty, express or implied, as to the accuracy, timeliness or completeness of the information, or as to the results to be attained by you or others from its use and shall not be in any way liable to recipient for any inaccuracies or omissions. You hereby acknowledge that you have not relied upon any warranty, guaranty or representation made by OSTTRA. The information herein is not, and should not be construed as, an offer or solicitation to sell or buy any product, investment, security or any other financial instrument or to participate in any particular trading strategy. Without limiting the foregoing, OSTTRA shall have no liability whatsoever to any recipient, whether in contract, in tort (including negligence, under warranty, under statute or otherwise, in respect of any loss or damage suffered by any recipient as a result of or in connection with any information provided, or any course of action determined, by it or any third party, whether or not based on any information provided.

TriOptima AB is regulated by the Swedish Financial Supervisory Authority and operates the following lklservices: triResolve, triReduce, triBalance, triCalculate and RESET. For more information, please visit https://osttra.com/