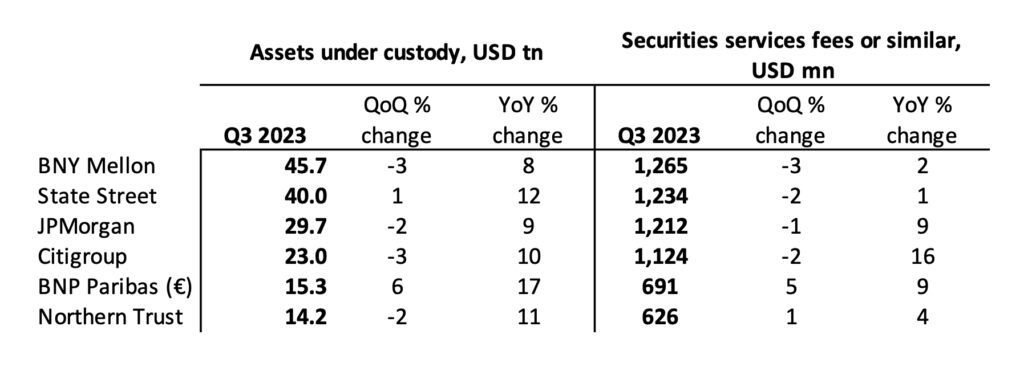

Stock markets are down in recent months, and the third-quarter reports from the top global custody banks reflect it. They show a quarter-on-quarter shrink – almost across the board – both in assets under custody/administration (AUC/A) and in the securities services fees. Against that, the environment of high interest rates kept working to their advantage.

By Ho Yun Kuan and Alexander Kristofersson

[This article was updated on 26 October with the reported figures for BNP Paribas.]

BNP Paribas and State Street were the only custodians in the global top six to report AUC/A growth in the third quarter. Northern Trust posted the only securities services fee growth. Numbers for both State Street and Northern Trust were up one percent compared with Q2, while BNP Paribas saw more significant growth with six percent.

The numbers for the YoY change look merrier at first glance, with growth for all players both in assets and fees – but remember then that the benchmark of end-September 2022 marked the low-point of that year’s heavy market dip, so that was an easy win.

Here, click the respective links for the source data documents from BNY Mellon, State Street, JP Morgan, Citigroup, BNP Paribas, and Northern Trust.

With the caveat that numbers may not be fully comparable, we list the top-six custodians by order of their volume of assets under custody. BNP Paribas and Northern Trust have been pretty much head to head lately, and their pecking order could depend of temporary swings to the currencies of the securities they safekeep.

No matter the size of the organisation, “favourable markets” and “net new business” were common reasons cited for YoY growth in AUC/A. Leading bank BNY Mellon stated in its report that “AUC/A increased eight percent YoY, primarily reflecting higher market values, client inflows, the favourable impact of a weaker US dollar, and net new business”.

Pointing out that “AUC/A and assets under management (AUM) are a driver of the corporation’s trust, investment and other servicing fees, the largest component of non-interest income”, Northern Trust, which sits at the bottom of the table, attributed its 11 percent YoY AUC/A growth and four percent YoY growth in asset servicing fees to “new business, favourable currency translation, and favourable markets, partially offset by lower transaction volumes”.

Coming in second to BNY Mellon with USD40 trillion in AUC/A, State Street reported that the 12 percent YoY growth was “driven by higher quarter-end market levels and net new business”.

Showing interest

Continuing since last year’s second-quarter reports, the interest rate continues to influence results. BNY Mellon reported “flat” YoY change in asset servicing revenue due to a disposal gain in Q3 2022, lower FX revenue, and a “strategic equity investment loss”, but stated that these were “partially offset by higher net interest revenue”. Likewise, the bank revealed that the YoY increase in issuer services “primarily reflects higher net interest revenue”.

Citi sang the same tune, citing that “securities services revenues of USD1.1 billion increased 16 percent, driven by higher net interest income across currencies”.