Fintech firm Meritsoft has launched its next-generation technology platform, which it describes in a press release as one that can offer institutions “advanced process automation capabilities”. Developed with application programming interfaces (APIs) in mind, it is expected to deliver “greater operational efficiency gains and cost optimisation opportunities”.

Firms using the new platform will benefit from better support for their post-trade processing requirements across ”fails management, financial transaction taxes (FTTs), CSDR penalty management, settlement efficiency, claims management, brokerage trade expense management, research, and commission sharing agreements (CSA)”.

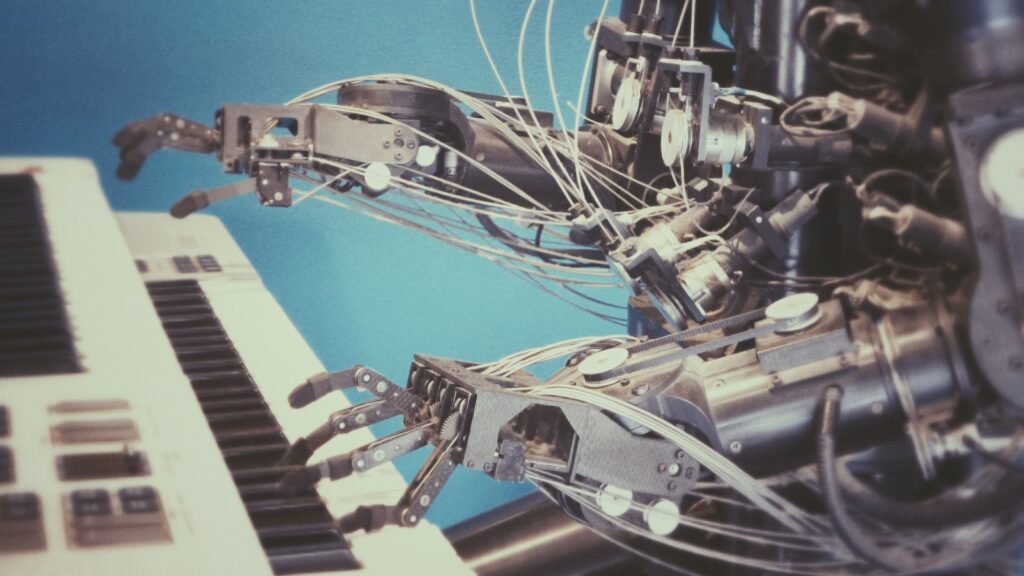

According to Meritsoft, data generated by the platform can be read by machine learning engines and AI tools, thus enabling predictive analysis. In addition, the platform can be hosted in both public and private cloud environments, depending on the client’s preferences. This enables “real-time scalability to meet capacity requirements in response to fluctuations in workflow demand and a general move towards cloud deployments”. It can also generate regular and component-level system updates if necessary, so that users can avoid “disruptive large-scale system update projects”.