The mandatory buy-ins were put on hold, but the fail penalties and other measures against trade settlement failure came into force on 1 February.

The article you are reading is the 54’th one topically tagged with “Settlement Discipline Regime (SDR)” in our publication. The measures are among the final parts to reach implementation, out of the mass of changes brought about by EU market and post-trade regulation after the financial crisis around 2008.

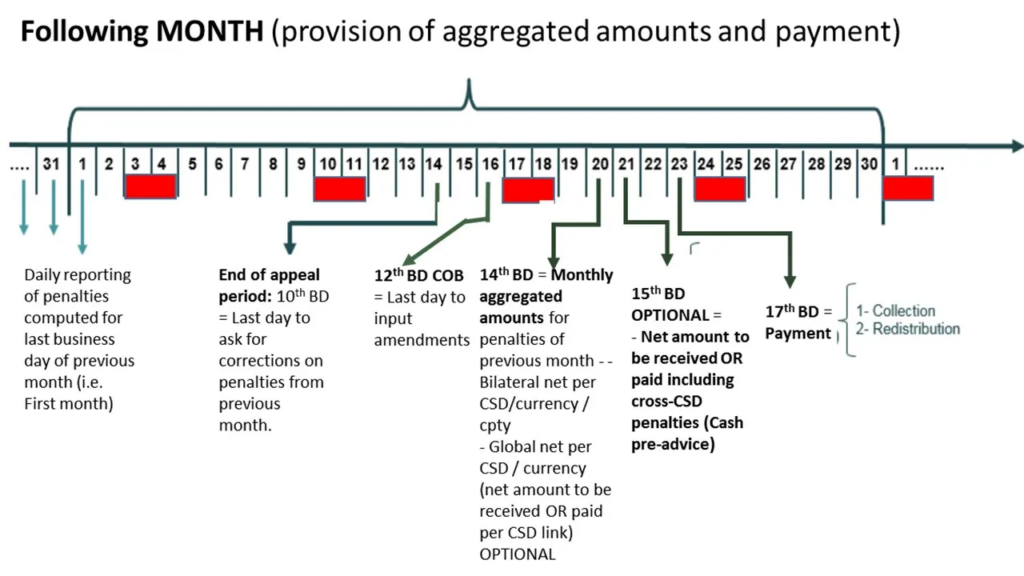

The SDR is part of the Central Securities Depositories Regulation, CSDR, and has in turn been built upon by the European Central Securities Depositories Association (ECSDA) to offer an “ECSDA CSDR Settlement Fails Penalties Framework”. Their illustration shows the “milestones” of the monthly reporting and appeal cycle.

One component of the package is the promotion of partial settlement. CSDs are being required to offer functionality to settle a part of the trade early in cases where either party can fulfill a part of its obligation but not all. While this makes it possible to avoid some of the fines that come with delayed delivieries, it can also add operational complexity since settlement goes from being a binary either/or to being of any amount.

Global custody bank BNY Mellon is among those who have summed up questions they often get; their 25-page FAQ report, published in September 2021, can be downloaded here.

The PostTrade 360° Stockholm conference on 29–30 March will feature an on-stage panel discussion to evaluate how it all turned out. Click here to learn more about conference and to sign up (to attend physically or remotely).