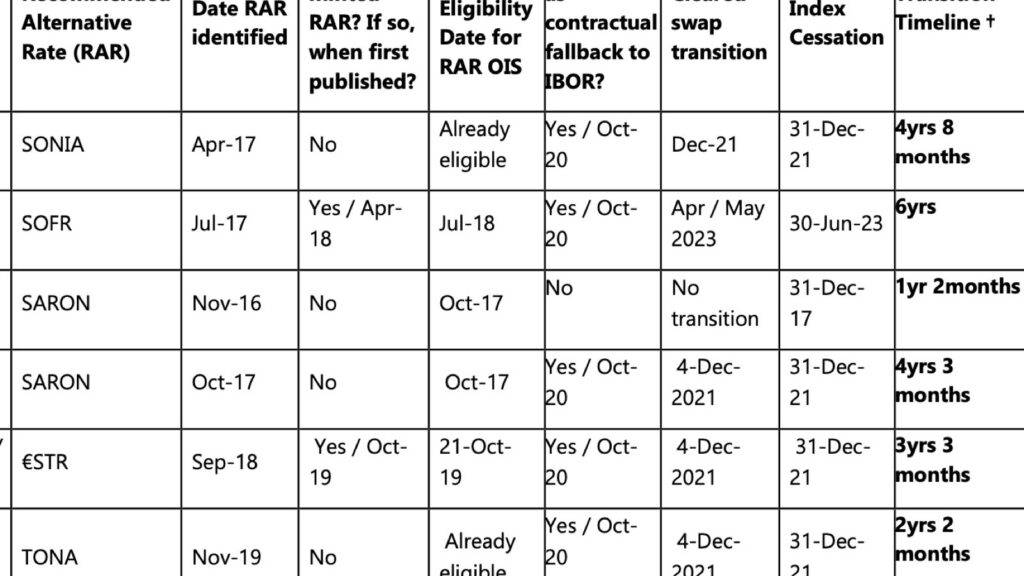

Orderliness and market adoption, rather than speed, should be prioritised as the traditional *IBOR reference interest rates in many markets are replaced with new risk-free reference rates, RFRs. This is what European clearinghouse association EACH argues, in a brief report reminding regulators and market participants how many years it can actually take to get the job done.

“This paper aims to consider the different stages involved in an orderly transition from *IBORs towards risk-free rates given the experience accumulated in previous transitions. This should hopefully contribute to ensuring realistic timelines in future transition roadmaps towards risk-free rates,” writes the European Association of CCP Clearing Houses, EACH, in its press release for the report.

The full eight-page report is downloadable here.

The note looks extra closely at Switzerland’s move from TOIS to SARON.