Cross-border investments, DLT pilots, settlement efficiency … and the vision for global post trade … These are the main themes that the organisers of the three-day World Forum of Central Securities Depositories expect to see in focus. On Wednesday afternoon, the event kicked off at the venues of the Czech central bank.

The opening note was held by Clearstream risk-committee chairman Mark Gem, in his role as chair of the board also for the European CSD Association (ECSDA) and the World Federation of CSDs (WFC).

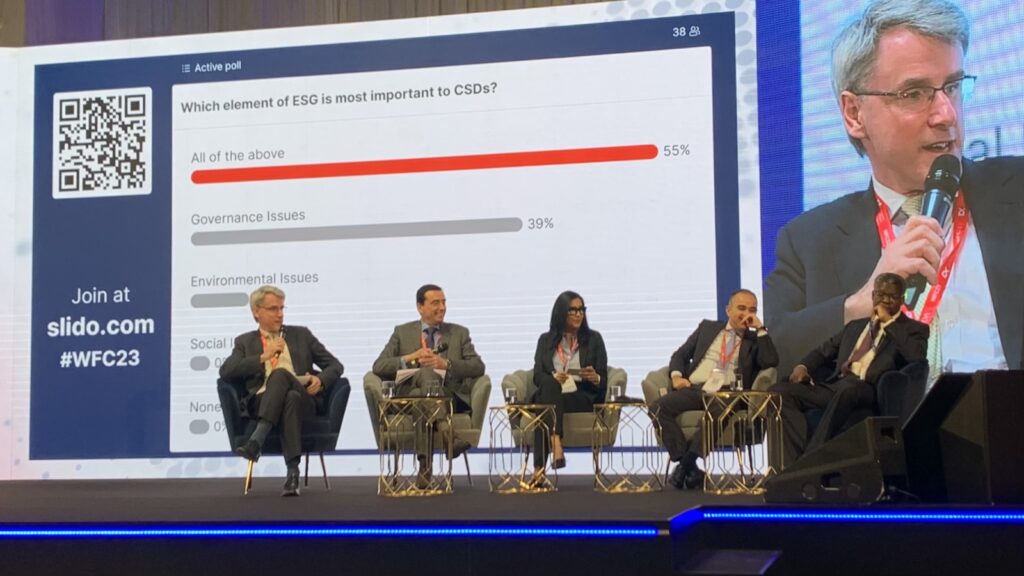

A five-speaker panel looked into the opportunities for CSDs to play an efficient role in aggregating ESG data from issuers, for use by investors, including fund managers and their clients. (The specific topic was discussed also at PostTrade 360° Stockholm in March; that session, too, saw Paul Symons on the panel.) Panellists in Prague on Wednesday were …

Paul Symons (this time moderator), Chief Sustainability Officer and Group Chief of Staff, Euroclear,

Francisco Béjar Nuñez, Head CSD Services, SIX,

Olga Cantillo, Executive Vice-President & CEO, Latin American Stock Exchange (Latinex, Panama),

Hayk Yeganyan, CEO, Armenia Securities Exchange, and

Emmanuel Alao, Chief Operating Officer, (Nigeria’s) FMDQ Depository Limited.

Audience sees the value of governance

A poll of the audience singled out governance (the G of ESG) as the clearly most important of the three letters, ahead of environmental and social concerns as such. Paul Symons referred to having been to another event recently, with a different audience, where the environment dominated the poll response completely.

Hayk Yeganyan described how ESG such as gender equality, in the case of his own nation Armenia, is not an internal pressure so much as a good opportunity to comply with emerging global investor preferences, making the country an attractive one. He advised against the thought that those CSDs who are de-facto monopolists in their countries could force issuers to supply ESG data as a condition for accessing the CSD services.

Asked about their 10-year expectations for their CSDs, the speakers mentioned areas including not just the data provision and ESG contributions, but also the possibility to promote efficiencies based on new technology.

BIS committee explores global improvement

In the area of policy development and market-infrastructure supervision, economist Jenny Hancock shared her insight from the BIS Committee on Payments and Market Infrastructures (CPMI), where she is a Member of Secretariat.

CPMI conducts joint work with the International Organisation of Securities Commissions (IOSCO) to set frameworks on business continuity planning, stablecoins, wholesale digital tokens, FX settlement risk, CCP resilience, recovery and resolution, non-default losses and margin.

Starting from the big picture

By your reporter’s rough estimate, some 200 delegates were in the room in Prague. Digital occurences of the event have taken place through the Covid years, but this was the global industry association’s first physical meet-up since its 2019 conference in Marrakesh.

The opening day took the broad economic perspective – with a view to how CSDs should be able to support even the future of the planet, in ECSDA general secretary Anna Kulik’s opening words. The coming days were scheduled to go into current detail and future vision.

• The World Forum of Central Securities Depositories runs in Prague 24–26 May 2023. Our coverage of it is listed here.

(Our posts will be low on direct quotes, as the event welcomes journalists on the condition that such must be explicitly confirmed with each speaker, which adds an operational hurdle.)