VIDEO | “By some of the research that we’ve done over the last few months, there are legacy systems in the US that may not be able to cope with this,” said IHS Markit product management director Bill Meenaghan, as he took part in this panel at PostTrade 360° Stockholm the other week. See the full session here.

The panel featured …

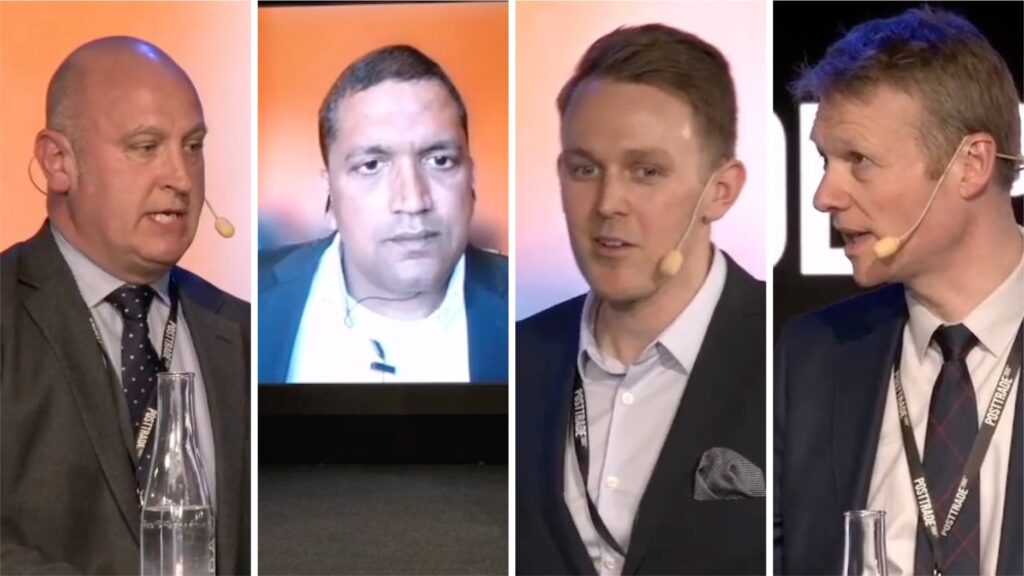

Lieven Libbrecht, Head of Product, Euroclear

Kristoffer Sønderlev, Head of Custody & Settlement Products, Euronext Securities Copenhagen

Bill Meenaghan, Director, Product Management, IHS Markit,

under direction of Vinod Jain, Senior Analyst, Capital Markets, Aite-Novarica Group.

John Abel, Executive Director, DTCC, was also scheduled to take part in the panel, via video link, but his participation was obstructed by a technical issue.

Let the white dots in the player bar guide you to sections touching on aspects like the need for tightening of the allocation process at back offices, the impact on corporate actions etc, what clients demand, the need for dashboard overview across systems, the arguments for skipping straight to DLT-based settlement, the impact we can expect from disruptive solutions, the question of who will pay, and a possible disconnection from FX processes.

In the US, the central securities depository DTCC leads a determined campaign to shorten the settlement cycle for equity trade, from a T+2 basis to T+1. Across the many nations of Europe, a similar move would take a lot of coordination but still seems to be the direction things are going. This session discusses what it means for infrastructures, and how market participants should prepare to maximise the benefits and minimise the hassles.

• PostTrade 360° Stockholm 2022 took place on 29–30 March. News around the event is gathered here.

• The conference info site, with detailed agenda, is here.

• Sign up here for our next conference, in Oslo on 5 May.

• By the way … are we connected on LinkedIn already, among the 2,300 post-trade pros who are? Follow us here.