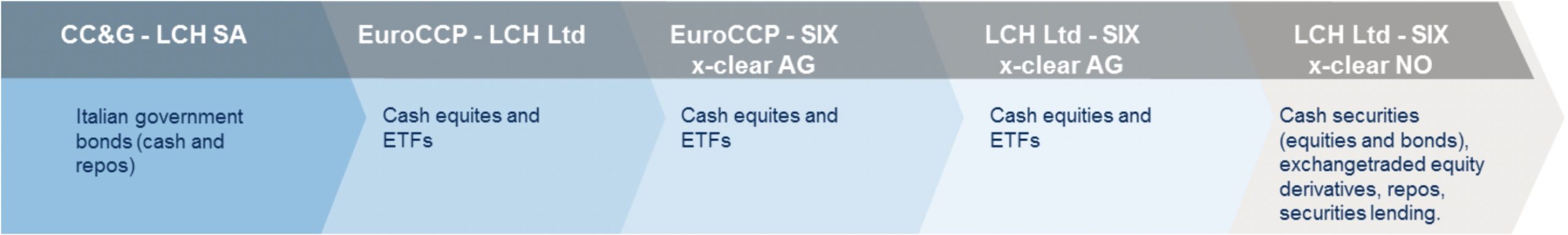

To its proponents, CCP (central counterparty clearing house) interoperability, namely cross-border linkages between two or more CCPs, is credited with increasing user choice in terms of where trading firms can clear their transactions and cost efficiency. Enshrined under the European Market Infrastructure Regulation (EMIR), there are currently five separate interoperability arrangements in place across Europe, mostly covering cash equities, exchange traded funds, bonds and exchange traded equity derivatives although other OTC derivatives remain out of scope. However, interoperability is not without its critics.

A driver for client choice

Historically, financial institutions in Europe had limited options over where they could clear their trades, insofar as it was only possible to do so through the CCP tied to a particular trading venue. Through CCP interoperability frameworks, trading firms can now clear their transactions for multiple trade venues at a single CCP. Not only does this result in users reducing the number of CCPs where they need to place collateral and share risks, but clearing costs have also fallen dramatically. Consequentially, this incentivises users to trade more frequently, and be active on more exchanges and MTFs, which in turn has generated deeper market liquidity and provided a comparison basis for best execution.

Regulators sound the alarm

Roger Storm, Head of Regulation, Risk and Committees at SIX, said that while there exists several years of proof that CCP-interoperability works, for CCPs clearing listed cash instruments, they do have reservations about such arrangements being extended to derivatives. Recital 73 of EMIR, for example, states that CCP interoperability should be restricted to transferable securities and money market instruments, adding OTC inclusion might create additional complexities due to the asset class’ longer maturities.2 The European Systemic Risk Board (ESRB) recently said that a regulatory clarification is needed regarding use of interoperability-links for derivatives. The close-out processes, and some of the tools foreseen in the proposed EU Recovery & Resolution regulations for CCPs are more difficult to apply in such contexts. This could then lead to contagion risk as a result of inter-CCP exposures, and where there is no limits to such exposures, a potential build-up of long-open positions on just one side.3

Protecting the market

“Regulators want firm assurances that interoperating CCPs can close out their positions in the event of a clearing member default, something which could have systemic risk implications. In response, SIX has implemented stringent risk management processes to safeguard against such a scenario arising,” said Storm. For instance, SIX x-clear – similar to other interoperating CCPs – has created a permanent inter-CCP fund to cover its inter-CCP liabilities in line with regulatory expectations. Such measures should be sufficient to close out positions where the two largest clearing members, or another CCP, defaults under extreme, but still plausible, market conditions, added Storm.

Source

1) 2) 3) ESRB (January 2019) CCP interoperability arrangements

Roger T Storm

Roger Storm is Head of Regulatory Matters, Risk & Committees of SIX x-clear Ltd, a subsidiary of the SIX Group, one of Europe’s leading providers of Exchange, CCP Clearing, Settlement, and Payments services. Besides acting as Deputy Head SIX x-clear, and being part of the executive management, Roger is in charge of regulatory policy matters, stakeholder and 1st line risk management. Alongside these duties, he is also vice-chairman of the policy committee of the European Association of Clearing Houses (EACH).

In a career spanning 27 years in international banking and financial market infrastructures, Roger Storm has acquired a wealth of senior management experience, in markets as diverse as Germany, France, the UK, Japan and Scandinavia. He has held a number of distinguished positions in SEB – Skandinaviska Enskilda Banken AB (as Managing Director for SEB France, Head of Strategic Projects, Global Head of Products, Head of Credit Functions) as well as Board positions at SWIFT, Bankgirot, the Swedish banking association, and EBA Clearing (where he was subsequently also Executive Director, Chief Risk Officer and Head of European Bank Relationship Management).

Roger Storm earned an MBA from Stockholm School of Economics, holds a Bachelor’s degree in Law, Business Administration and Economics from the University of Stockholm, and is a Certified Financial Analyst (CFA).