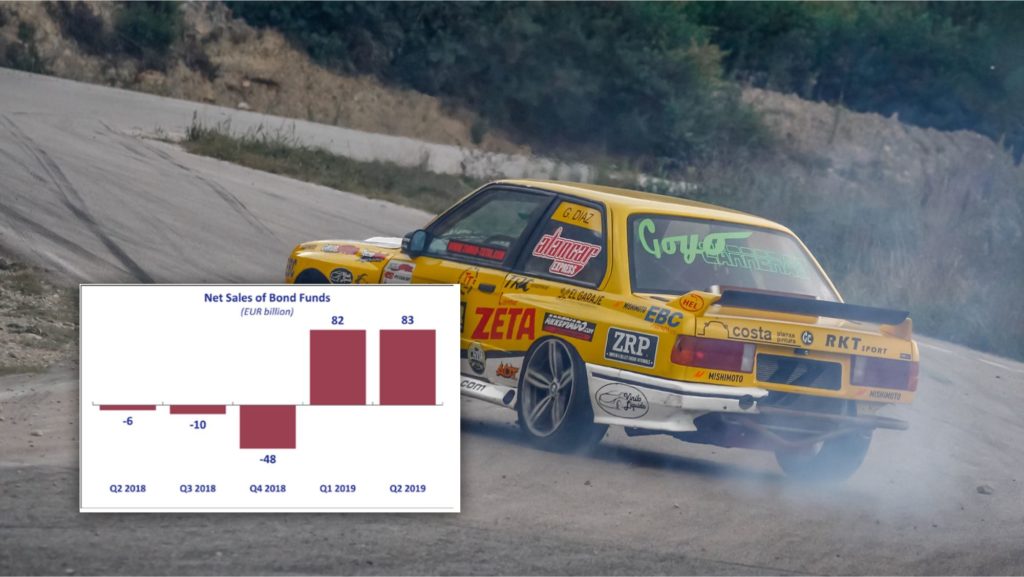

A continuing “bond fund rally” is how European fund industry association EFAMA sums up this year’s second quarter. Equity funds, meanwhile, saw outflows.

Net sales of bond funds in the European investment fund industry summed up to €83 billion in the three-month period from April to June, according to the European Fund and Asset Management Association (EFAMA),

The figure is close the corresponding net sales number for the preceding quarter, January–March: €82 billion.

Equities took a hit

The region’s equity funds saw the escape of €32 billion during the second quarter, not fully as bad as the €38 billion in the quarter before.

“Slower growth and reduced inflationary risk raised the status of long-term government bonds as safe-havens for investors in Q2 2019. At the same time, the US-China trade war, geopolitical tensions and Brexit uncertainty resulted in global growth worries and stock-market volatility, which led to a rise in investor risk aversion and a fall in demand for equity funds,” says Bernard Delbecque, Senior Director for Economics and research at EFAMA, in a press release.

EFAMA’s full quarterly statistical report can be found here.