DACSI’s new scenario whitepaper sketches four alternative scenarios for Europe’s securities post-trade sector in a five-to-ten-year perspective. It discusses the implications that each of these could have on CCPs, CSDs, custodians and other actors in the field.

This is a fact article accompanying this interview with DACSI’s Henk Brink about the scenario report. Join Wednesday’s PostTrade 360° Amsterdam conference where he will present the findings (at 15:15 CET). You may need join code PT360A

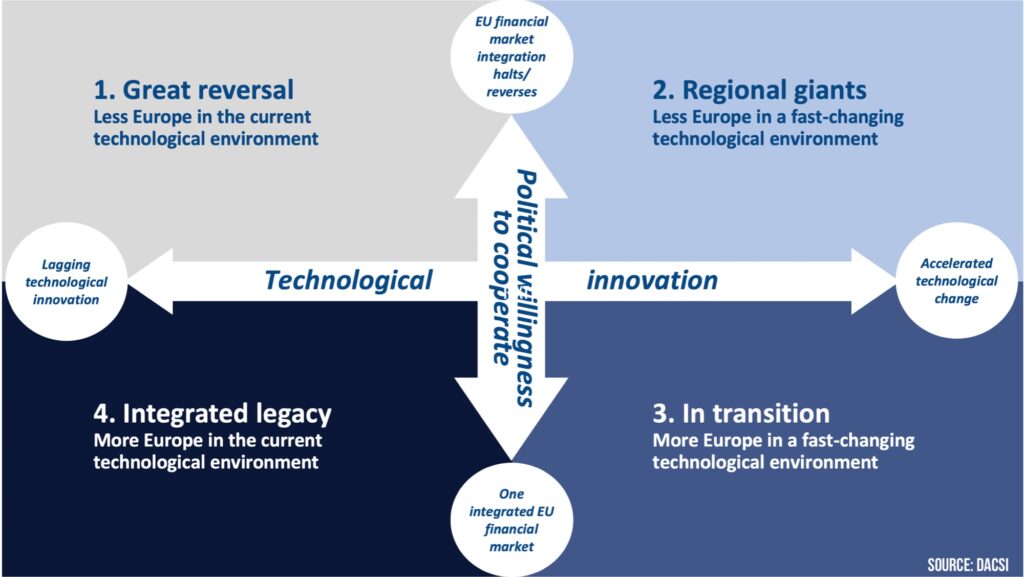

According to the analysis, the outcome will depend on two dominant uncertainties:

1. The degree of political willingness to cooperate. This determines the level of regulatory integration of European financial markets, including oversight and barriers.

2. The degree of technological innovation. The speed at which new and existing technologies will accelerate change in post-trade solutions and services.

With either of the two variables moving either back or forward, it makes for four combinations – four qualitatively different futures. If the movement towards market integration would halt or reverse, we are up either for a “great reversal” or a landscape of “regional giants”.

If, on the other hand, the EU could actually create an integrated financial market, we would enter either an “integrated legacy” scenario or an existence “in transition”.

In the DACSI report, each of these are accompanied not only by closer descriptions and lists of the impacts they would have on post-trade actors. There are also lists of the early-warning signs that ought to trigger closer planning or action. For example, the list of possible early indications of the “In transition” case (a technologically fast-changing, and financially integrated, market) includes, among other points …

• EU adoption of regulation for tokenised assets,

• an agreement on convergence of securities laws, agreements on tax withholding procedures, or

• the event that a FinTech/ BigTech launches an app that integrates pre- and post-trade into a user-friendly solution.

With this as inspiration, your organization could take the next step: to identify what would be the consequences for you, and what indicators you should look out for to know when you should trigger alternative activities.

To receive the report, send a mail to secretariat@dacsi.nl.

Find our two-page printable agenda for Amsterdam here, and our full conference magazine here.

By the way … are we connected on LinkedIn already, among the 1,400 post-trade pros who are? Follow us here.