They used to be a bank. Now they are a global cloud of interconnected post-trade services you can pick and mix from. PostTrade 360° Stockholm on 25–26 March will see Vinod Jain, consultant with Aite Group, line out how custodians as well as their clients are forced to ask themselves new questions.

What is the most important factor when you consider outsourcing elements of your back-office operations? Would you say you look for cost-cutting, or fast-footed action in volatile times … or perhaps even new capabilities to support new lines of business for your firm?

“We see the capital market as one – but at the same time it is all fragmented in the sense that you can execute and process trades in multiple ways now,” says Vinod Jain, senior analyst at Aite Group, a financial services industry research and advisory firm.

What is your opportunity in this?

In his session with PostTrade 360° Stockholm, he will zoom in on the various drivers behind today’s major changes across the post-trade landscape. With an understanding of these drivers, delegates from various types of firms should be better equipped to figure out what implications they can expect – and how they should grab the full advantage.

”We see the evolvement of the custody bank service providers. We used to think that the assets under management was the key to differentiating the services. But now, buy-side firms who want to evaluate service providers have become much smarter in identifying what matters to them. Being big doesn’t mean providers are always good. And being small doesn’t mean that they don’t have capabilities,” says Vinod Jain.

With the divergence in services, technology enables custodians and their clients to identify, together, what is the best way for them to have the tasks performed.

“The big banks can provide the scalability factor, can acquire other firms more quickly and back innovative ideas. They can make new offerings to the buy-side firms in providing data as a service, let’s say. But a smaller firm could still provide the same functions to the asset servicing side, the services which can be economical to the buy-side client as well as to themselves.”

Enjoy consciously

As a senior analyst, Vinod Jain covers a broad range of post-trade topics – including custody strategies in the light of maturing front-to-back integration across companies, but also collateral management, the impact of DLT in the settlement space, etc. Custodians need to ask themselves what services they ought to offer. Conversely, buy-side firms need to ask themselves what services they should be buying, from whom – and what technical capabilities they must have in place to enable it. With the growing possibilities to connect modules of software service across the internet, a new world of operational opportunity has opened up. But how do you choose?

“The decisive thing is to identify what the buy-side firm wants to achieve in its business and operating model,” says Vinod Jain.

“Do you want just simple cost reductions over two to three years? Then you need to take the costs of outsourcings and integrations, against the cost reductions by outsourcing, into account. Secondly, whichever sourcing model you choose, you need to consider how you safeguard yourself from increased volatility at any point in time. The third thing is how they could have more alternatives in the trading, so they can expand their side of the business.”

Climbing up the value chain

Vinod Jain sets today’s situation against the background of how we got here. A key force is the desire among buy-side firms, brokers and others to outsource operational tasks seen as non-core to their businesses or to leverage cost reduction opportunities. For custodians – whose traditional safekeeping of securities has become commoditised and price-squeezed – this has presented opportunities to diversify their outsourcing offers.

While the outsourcing setups started from relatively standardised high-volume tasks – such as reconciliations and accounting in the back-office space – the service providers have gradually climbed their way up the value chain and now produce, for example, complete front-to-back-office outsourcing solutions. Thus, increasingly, a complete service portfolio by today’s standards is also expected to span trade execution as well as the trade processing and servicing.

“On the custody bank side, you see the upward chain of integrations. I think the rise of BlackRock and its investment into Aladdin as the platform for its funds processing, and State Street’s acquisition of Charles River, are the game changers because – in terms of having an ability to execute, process and service the trade – that gave unique combined offerings,” says Vinod Jain.

This doesn’t mean Vinod Jain is singling out BlackRock and State Street as overall front-runners.

“I think all the custody banks are moving into that space.”

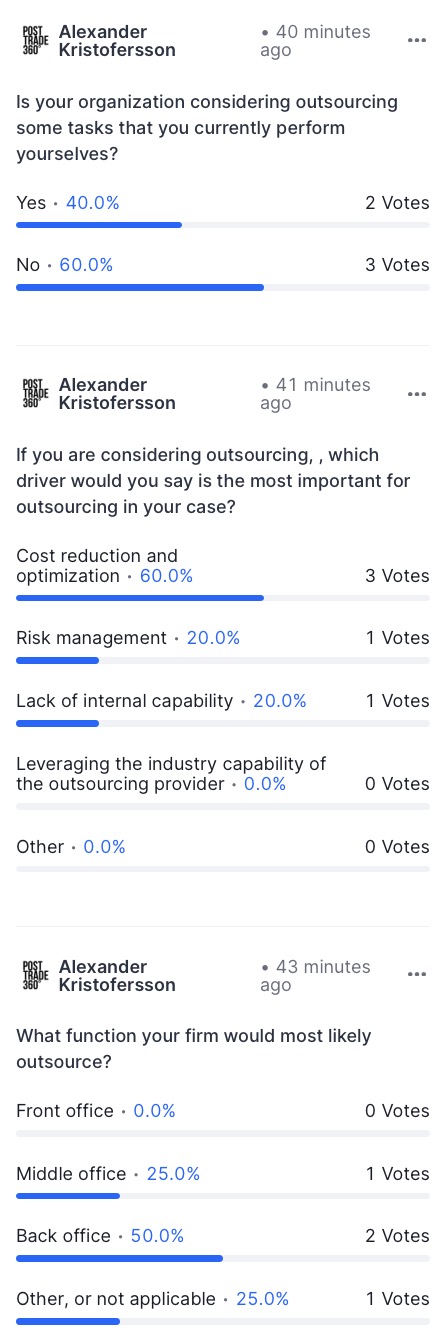

Update 25 March 2021: In Vinod Jain’s session today at the PostTrade 360° conference, he pioneered the event’s use of audience polls. A small but exclusive set of delegates responded as this table shows. Responders are not necessarily the same between the separate questions.

• PostTrade 360° Stockholm 2021 took place on 25–26 March. News around the event is gathered here.

• Find the 44-page event magazine here.

• By the way … are we connected on LinkedIn already, among the 1,600 post-trade pros who are? Follow us here.