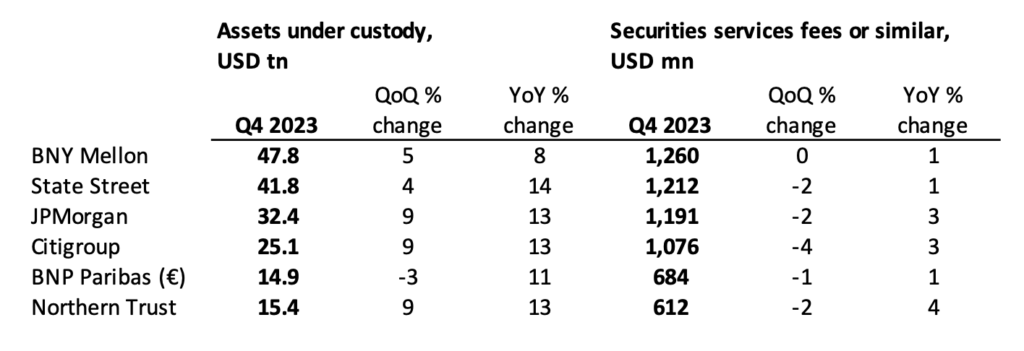

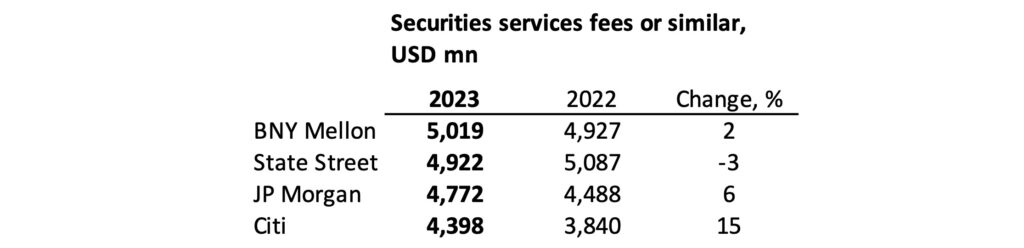

Despite a sense of bravado and careful optimism in the reports for the Q4 2023 results, 2023 ended on a rather subdued note for the top global custodian banks. Based on numbers from the six biggest players by assets under custody, total securities services fees grew from about 5.96 billion dollars in Q4 2022 to 6.11 billion in Q4 2023, a 2.5 percent increase.

By Ho Yun Kuan and Alexander Kristofersson

[This article was updated on 2 February 2024 with reported figures for BNP Paribas.]

With US inflation of 3.4 percent through the year – higher than the fee growth – the industry’s fourth-quarter fee revenues can thus be said to have seen a decrease in real terms.

Despite these challenges, custodians were not without relief. They were given some valuable help, both through the full year and last quarter, from higher market prices in the assets they service, and by the relatively high interest rates compared with recent years. The latter phenomenon was in play not only in the last quarter, but since Q2 2022.

Click here for the source documents: BNY Mellon, State Street, JP Morgan, Citi, Northern Trust, BNP Paribas

With the caveat that numbers may not be fully comparable, we have listed the top six custodians by order of their volume of assets under custody or administration (AUC/A), or just assets under custody (AUC) when that is what the report presents. Differing scopes of the revenue numbers could be another factor that disturbs the comparability, so keep that pinch of salt at hand.

Net interest grew

At BNY Mellon, higher rates contributed to a net interest revenue increase of 24 percent YoY, but this was “partially offset by changes in balance sheet size and mix”. Besides higher interest rates, new business also contributed to the bank’s growth.

Breaking down its drivers of total revenue into its different lines of businesses, BNY Mellon revealed flat YoY growth in its asset servicing revenue, “primarily reflecting lower foreign exchange revenue and net interest revenue”. This was, however, offset by ”a strategic equity investment gain and higher market values”, and later, a sequential increase that reflected “improved strategic investment results and higher net interest revenue”. Issuer services revenue saw a YoY increase due to “net new business and higher client activity”, as well as, again, higher net interest revenue.

New business was also cited as a positive contributor at State Street. Its report wrote that the 14 percent YoY increase in the bank’s AUC/A to US$41.8 trillion was “largely driven by higher quarter-end market levels and net new business”.

Despite a two percent QoQ decrease in servicing fees, which State Street attributed to “pricing headwinds and a previously disclosed client transition”, the higher level of client activity and adjustments resulted in a couple of “wins”. New servicing fee revenue wins amounted to US$103 million, and was “primarily related to wins in back office custody, including private markets”. For AUC/A, the majority of the new servicing wins of US$501 billion were from the asset managers and alternatives segments.

Took hit in Argentina

Citi credited the higher interest rates for cushioning its performance, stating that the 3-percent increase in its securities services revenue was “driven by net interest income growth of 11 percent”. This was, however, “partially offset by a four percent decline in non-interest revenue, largely reflecting the Argentina devaluation”.

For Northern Trust, quarter-on-quarter (QoQ), “custody and fund administration fees decreased sequentially primarily due to unfavourable markets”, but the same fees saw an increase YoY “primarily due to favourable markets, favourable currency translation, and new business, partially offset by asset outflows”.

The industry is not expecting the tough environment to let up; Michael O’Grady, Northern Trust’s chairman and CEO revealed in a statement that the organisation’s focus for this year would be on accelerating profitable organic growth, maintaining expense discipline, and driving greater resiliency and efficiency in the operating model.

Numbers appearing for off-list candidates

Below the actors we have listed as the top-six, one finds further players, including HSBC, Caceis, and SGSS. When we have previously looked for their corresponding measures, these have generally been harder to spot, but we now see pockets of increasing transparency.

On a new line for “Assets under custody” (on page 21 here), HSBC revealed a figure of US$ 8.3 trillion dollars per the end of the third quarter of 2023. Year-end numbers are still due.

France-based Caceis, meanwhile, now states on its front web page that it held assets under custody of €4.7 trillion and assets under administration of €3.3 trillion per 31 December 2023 – so, € 8.0 trillion if summed. These numbers should include the boost from Caceis’ acquisition, announced in autumn 2022, of the European asset-servicing parts of Royal Bank of Canada. Per our news post at the time, the value of the transferred assets then made up € 1.2 trillion under administration and € 0.5 trillion under custody.