Financial intermediaries – namely traditional banks and retail brokers – are dealing with a number of difficult headwinds. With Sweden’s Avanza as one of the reference points, Gary O’Brien, Global Head of Banks and Brokers at BNP Paribas Securities Services, discusses how these can successfully rethink their model.

In order to flourish amid today’s challenging market environment, many financial intermediary organisations are now looking to leverage “Broker to Custody” solutions to obtain operational efficiencies and improve their own underlying customer services. Gary O’Brien, Global Head of Banks and Brokers at BNP Paribas Securities Services, shares his insights on how the bank’s Broker to Custody product can support intermediaries – as they look to future-proof their businesses and grow revenues.

Could you please give an overview of some of the main challenges facing your intermediary clients?

O’Brien: Right now, intermediaries are under intense pressure. Banks and retail brokers are facing mounting competition from new entrants, many of whom are expanding their market share at the former’s expense. There are several reasons explaining the success of these new entrants. Firstly, they are unconstrained by the legacy technology problems inhibiting the incumbents, which has enabled them to more seamlessly integrate cutting-edge digital features into their front end solutions. Through the adoption of digitalisation, new entrants are making in-roads by winning mandates from tech-savvy retail investors. It also allows providers to offer retail clients highly bespoke services. This is vital – given that investors are increasingly seeking out returns in new markets and products, owing to some of the challenging performance conditions in traditional fixed income and equity markets. As these providers continue to expand wallet share, the incumbents are looking for ways in which to respond.

How are the incumbent providers attempting to future proof their businesses?

O’Brien: In order to compete with these new players, some incumbent brokers and banks are doing one of two things. They have either reduced fees to maintain their client base, or invested into their technology systems and processes so as to remain competitive. However, both of these approaches are likely to have a negative impact on margins. Others have opted to identify cost efficiencies within their core business. For instance, some banks and brokers are looking to rationalise their sub-custody networks by working with fewer providers to keep supplier oversight costs down. Alternatively, other intermediaries are creating partnership solutions – whereby they purchase more services from individual banks. The exponential growth of the integrated execution, settlement, and asset servicing solution – otherwise known as the Broker to Custody model – is indicative of this trend.

What does the standard execution/custody model look like, and what are its benefits?

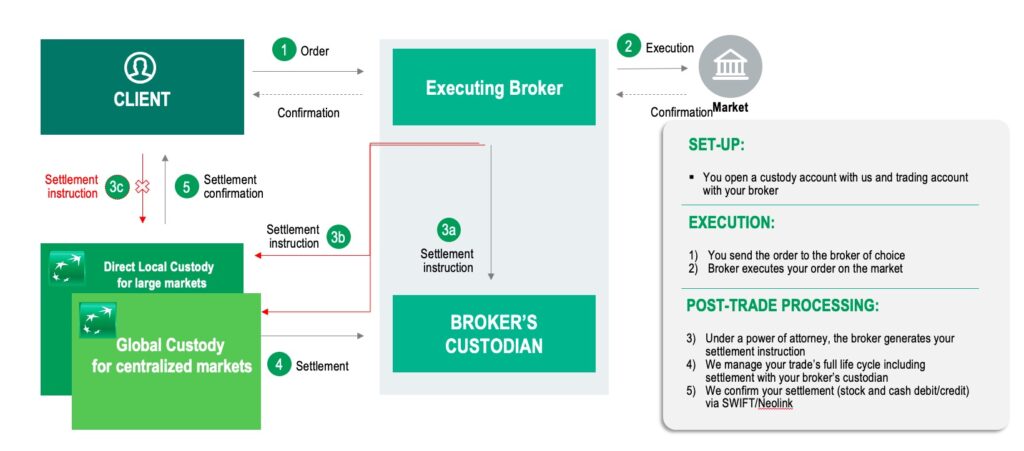

O’Brien: Traditionally, retail brokers have integrated their execution and asset servicing requirements with one provider. This effectively creates a single counterparty relationship covering all of the brokers’ activities. So how does this model typically work? A retail broker will send an order to an investment bank’s execution desk. The order will then be executed and a settlement notification is subsequently sent to the custody department to facilitate settlement on behalf of the retail broker. This structure enables the retail broker to net operational synergies as they no longer need to perform back office processing to support trade settlement. This also helps brokers reduce the risk of market failure – due to the integrated settlement instruction. Furthermore, this model is highly effective among retail brokers focused on specific markets and those looking to achieve scale. This is because it relies on a centralised custody relationship, which supports asset servicing in one location – normally through the global custody structure. This means that brokers can obtain easier access to new markets.

What challenges does the traditional execution/custody model pose for clients?

O’Brien: While the traditional execution/custody model is a sensible option for brokers to take, it does have limitations, not least because the entire set-up is wholly dependent on the capabilities and coverage of the investment bank’s execution desk and custody arm. This can sometimes result in brokers being constrained in terms of the markets and financial instruments which they are able to fully access. For instance, if a bank’s execution desk can only cover 12 markets and a handful of blue chip stocks, then that intermediary can only invest in those 12 markets and blue chip securities. This is a serious weakness, particularly as retail investors are becoming more sophisticated, and are seeking out better performance and risk diversification through exposure to new markets and instruments.

Please give an overview of BNP Paribas’ Broker to Custody solution and what are its core strengths?

O’Brien: BNP Paribas has strengthened its core electronic execution capabilities. The bank has a truly global offering – which supports flexibility in terms of the booking location for execution. The bank’s custody model enables intermediaries to enter into contracts with its branches in local markets. We provide access to 90+ local markets – together with a centralised global custody set-up for some of the less strategic markets. In addition, we offer access to all of the major asset classes – principally equities, bonds, warrants and funds. We also have capabilities in place to help retail brokerage clients expand into new markets and asset classes – in what should help them win more investor mandates.

What differentiates BNP Paribas Securities Services’ solution relative to those offered by your peers?

O’Brien: Most significantly, BNP Paribas Securities Services’ Broker to Custody tool lets clients leverage other execution providers on demand in addition to the bank’s own in-house execution desk. This gives clients a level of flexibility not normally available to them through other providers. By partnering with multiple, top rated brokers, our clients can benefit from a best of breed and tailored solution. It is advantageous from a risk management perspective too, as clients can port business to a different execution desk if there are issues at their primary provider. Operationally, this set-up has limited impact on intermediaries as they can continue to pass settlement instruction responsibilities to their chosen brokers. Beyond that the solution supports automation, simplifies the trade lifecycle process for clients, enhances STP (straight-through-processing) thereby minimising the risk of trade fails, and reduces cost and risk through netting, aggregation and book entry settlements. Furthermore, BNP Paribas Securities Services provides standardised and agile reporting capabilities – meaning clients now receive reports in the same format irrespective of the individual custody arrangements which they have implemented.

How do you see the product evolving moving forward?

O’Brien: As retail investors evolve, brokers will need to offer clients a wider range of services. A number of intermediaries are looking to augment returns for their underlying clients through BNP Paribas Securities Services’ securities lending capabilities. Retail investors – who may traditionally sit on long positions with low transactional volumes – can now lend out their assets via BNP Paribas Securities Services’ securities lending desk, thereby generating a return on their investments. Other services such as foreign exchange can also be integrated into the offering in a way that provides total transparency to end customers. Elsewhere, sophisticated asset owners are becoming more empowered and are bringing asset management activities in-house. We anticipate that the Broker-to-Custody solution will be very attractive to these investors as they look to obtain a one-stop shop for their custody and trading needs.

Case study: Sweden’s Avanza

Avanza, a leading Swedish online bank with more than 1.5 million retail customers, outlines why it selected BNP Paribas Securities Services’ ‘Broker to Custody’ product.

Please give an overview of the challenges you were facing.

Avanza (Client): As a fast growing provider to retail clients, our main challenge was to find solutions and partners that could keep up with the evolution of our product. As our end customers increasingly sought out new markets and instruments, we looked to BNP Paribas Securities Services’ agile “Broker to Custody” solution.

How did BNP Paribas’ Broker to Custody solution solve your issues?

Avanza (Client): BNP Paribas Securities Services’ solution is incredibly agile, and it enables us to expand into new markets and instruments with ease. We have worked with BNP Paribas for more than 6 years and it has continuously supported and adapted its solutions in tandem with our business requirements.

Through its excellent reporting functionalities, best-in-class custody and execution capabilities, BNP Paribas has helped us deliver a premium end-to-end service to clients.

We see BNP Paribas Securities Services as a partner who are continuously catering for our evolving business requirements.