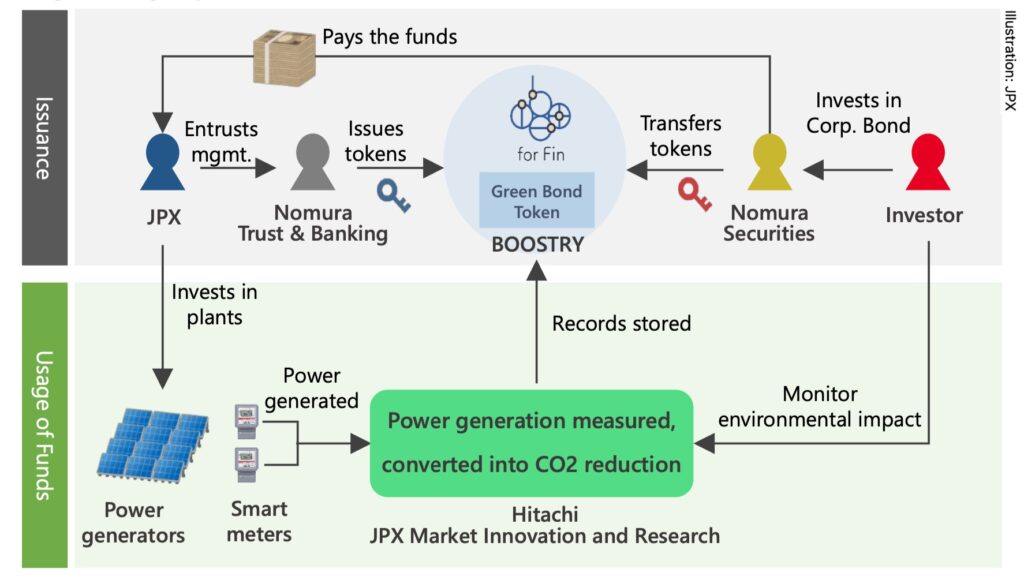

In a first for Japan, the country’s stock exchange operator JPX issues bond tokens on a blockchain to finance carbon-emission reductions at power plants. Hitachi will measure the energy produced and translate it into CO2 reduction metrics. Nomura underwrites.

The details have been lined out in this press release from JPX, the corporation that owns the Tokyo Stock Exchange. The setup will be built on a blockchain platform called Boostry.

“This digital bond will be the first issued for wholesale trading in Japan,” writes JPX, pointing out that it was legally enabled by digital bond definitions that came into effect on 1 May 2020.

Beside being Japan’s first wholesale-traded digital bond, JPX also describes the issue as the country’s first “digitally tracked green bond”, with investors being able to monitor their investment’s CO2 impact in real time.

According to comment by DLT-focused news site Ledger Insight, this “signals yet another stock exchange win for Digital Asset, as Boostry’s smart contracts use the DAML language. Other stock exchanges using DAML include ASX, HKEX, Deutsche Boerse, and [Bursa] Malaysia”.