[VIDEO] With 27 member nations in the EU, it stands clear that a shortening of the standard settlement cycle by a day can be nowhere near as smooth and quick as in the US, with its single CSD. A panel at the PostTrade 360° Amsterdam conference discussed what could be a path forward.

This session was sponsored by Deutsche Bank, DTCC, ERI, and S&P Global Market Intelligence.

“There is a demonstrable history in Europe of not making progress unless there is an imperative from the regulator”, said Andrew Douglas, who is Managing Director & Head of Government Relations EMEA & APAC, with DTCC, the US central securities depository that is leading the way for the quick T+1 implementation going on there. Market participants themselves will rarely come together with enough force, partly because they prefer postponing new investments until their existing platforms get old. Possibly, some phased approach could be a way, starting with some asset classes.

He was on the panel together with …

Erik Veerman, Senior Advisor Market Infrastructures, ABN AMRO

Kamala Kannan, Director, Product Management, S&P Global Market Intelligence

Richard Ozinga, Head of Product Management EMEA, Deutsche Bank,

and, as moderator, Alan Goodrich, Regional Sales Manager – Benelux, Nordics, Baltics & SEE, ERI Bancaire.

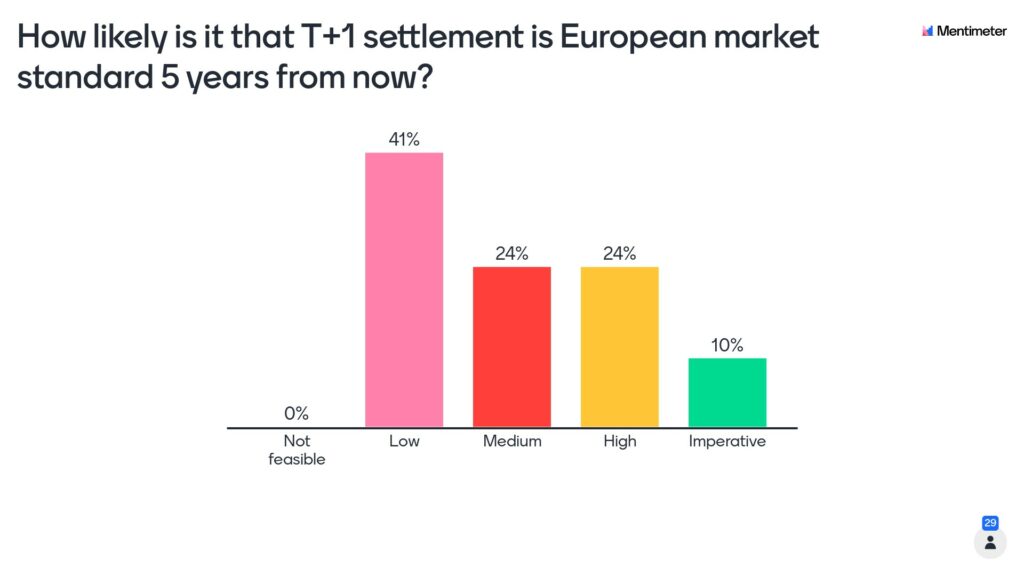

The audience was polled about the probability of the T+1 cycle being live as standard in Europe five years from now. This was the pre-session response, with 29 delegates voting. Over half the voters saw the five-year vision as medium-probable or above – an expectation level that the panel seemed to view as notably exaggerated. (A post-session re-take indicated that expectations had been lowered somewhat over the half hour.)

Alan Goodrich referred the idea that if we had started from a blank sheet, we would never have built today’s structure. The trouble being, that the sheet just isn’t blank.

Richard Ozinga proposed seeking process improvements first, then shorten the settlement when ready – rather than cut the settlement time and discover process issues the hard way:

“We have to deep dive into the real problems and solutions.”

• News around PostTrade 360° Amsterdam 2022, on 10 November, is gathered here.

• The conference info site, with detailed agenda, is here.

• By the way … are we connected on LinkedIn already, among the 2,600 post-trade pros who are? Follow us here.