36 per cent of respondents of a recent survey from Broadridge foresee a reduction in the need for intermediaries, like custodians and clearinghouses, with the adoption of blockchain and other distributed ledger technology (DLT). Based on insights from 500 senior executives, the survey highlights an inclination among financial firms to increase their investment in DLT.

According to the 2024 version of its survey on digital transformation and next-gen technology, a 20 per cent growth in DLT investment is expected over the next two years, closely trailing behind the 21 per cent investment increase for Artificial Intelligence (AI).

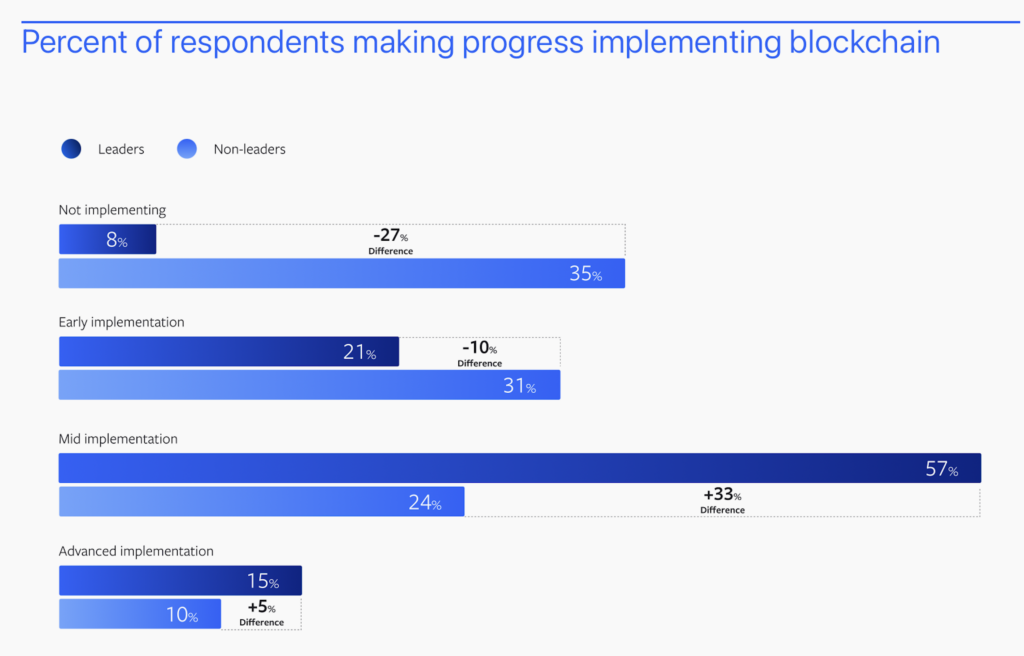

Companies participating in the questionnaire were segmented into two groups: technology “leaders” and “non-leaders”, based on criteria including innovation culture, automation adoption, and IT infrastructure. Leaders, representing the top quartile, showcased a higher level of engagement and advancement in blockchain and DLT implementation compared to non-leaders.

Progression stages

While 92 per cent of leaders were actively involved in DLT and blockchain initiatives, only 65 per cent of non-leaders demonstrated similar engagement. Moreover, a disparity in implementation progress was noted, with 72 per cent of leaders advancing to mid or advanced stages, contrasting with the 34 per cent reported by non-leaders.

85 per cent of leaders prioritised investments in cloud platforms, with non-leaders trailing by only 1 per cent. However, leaders displayed a substantial lead in generative AI investments, with 44 per cent making significant commitments, double the rate of non-leaders.