Could all DLT-based solutions for securities processing be sorted into twelve boxes, to make them understandable for us normal folks? Starting from his own need for a structure, Datos Insights’ industry analyst Vinod Jain has developed a 3 x 4 matrix to organise the space. Now, he suggests the whole industry could apply it – to better predict where an operations and technology shift will be good or bad for business. PostTrade 360° gave him a call.

“You have all these industry initiatives, business cases, use cases … but if you work with one of them, how can you describe to me just in which area you operate?” asks Vinod Jain, Strategic Advisor at Datos Insights, formely Aite-Novarica.

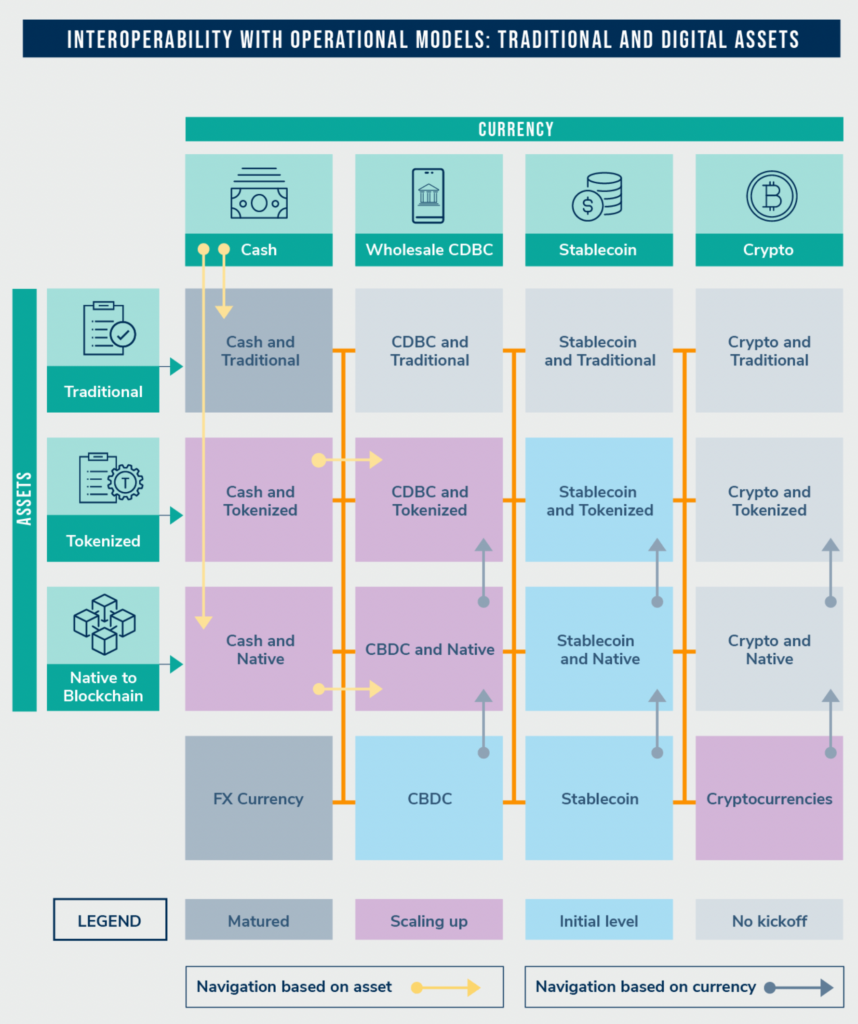

In a fact-box further down, you find a detailed description of the framework which he has recently presented in a 29-page report. It lets projects be categorised by their form of security on one axis, and the form of cash on the other. The boxes at each cross section will all see their own infrastructure and post-trade process develop. Yes, this will be complex in any case, but making sure one talks about the same box is a good start, Vinod Jain would argue. He is now in discussion with actors including the International Securities Services Association (ISSA), suggesting the industry could use it as a shared reference point.

See the grains

Just a few years ago, it was common to hear sweeping prophesies that distributed ledger technology (DLT) would revolutionise everything about securities processing, essentially making custodians and intermediaries obsolete. Today, the commentary has become more nuanced and specific, and if Vinod Jain’s analysis is correct, there is good reason: Some sub-processes will be revolutionised by DLT and some won’t … so, those catch-alls are meaningless.

Here, it is important to distinguish between connecting the different steps of a securities’ lifecycle – which will be required – and, on the other hand, the idea of having to use the same technology for all steps, which would not only be unnecessary but highly inefficient. A main point in Vinod Jain’s message is that our view needs to be granular. The adoption of DLT should start from the analysis of precisely where it will add the largest net benefit.

A case-by-case view on cost/benefit

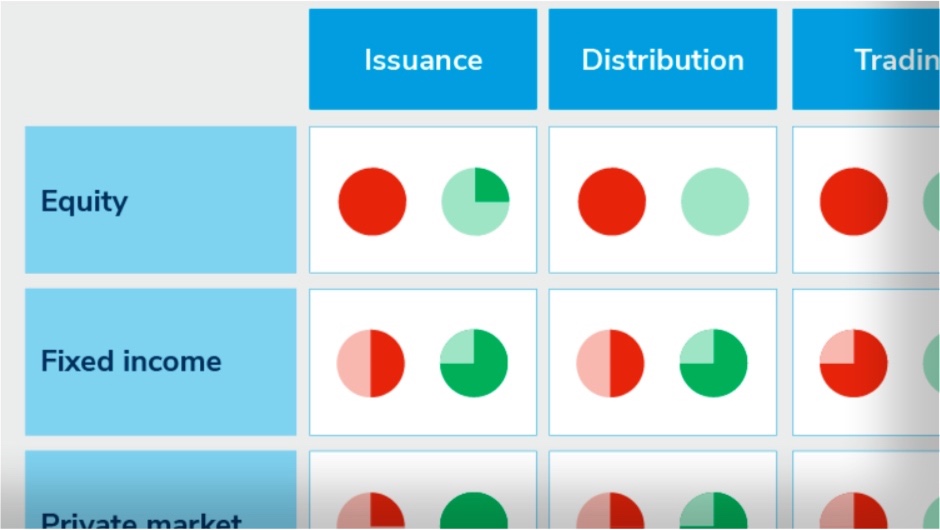

Beside the twelve-box matrix of assets-vs-cash formats, Vinod Jain has also produced a table that rates the cost and potential benefit of DLT adoption through different steps of the lifecycle. This goes into each of six asset classes: equity, fixed income, private market, etc. His scores, presented as red and green “Harvey ball” dials, are based on insights from 28 discussions with various securities-industry representatives who are involved with the technology.

“It highlights how DLT adoption will not work everywhere, because, at certain places, the cost will be higher than the benefit. But when you go deeper into it, you will find where the benefits of adopting DLT will exceed the cost,” he says and exemplifies:

“If you try to adopt DLT to equity trading, you will find there is no business case for it. But on the equity settlement side, there is. Similarly, there is no business case for DLT adoption in trading or clearing of over-the-counter derivatives.”

OTC derivatives have come far – without DLT

So, no case for OTC derivatives trading or clearing on DLT … why is that?

“When you trade OTC derivatives today, this is already done electronically on various MTF, OTF, or swap-execution facilities, with same-day clearing. We have gone through a restructuring phase in the last ten years, and I would say this has now stabilised, so we have gained tremendous benefits already, via clearing. To go into the DLT phase with OTC derivatives today, there would need to be something that could be issued on those DLT platforms, but there is actually nothing to it,” says Vinod Jain.

“Some proofs of concept may look promising initially, but are not scalable as there is no appetite for the industry to make another investment into the various nodes and adopt a new technology platform without significant benefits around it.”

But look instead at the collateral movement side of OTC derivatives business, and the DLT prospects improve. Vinod Jain mentions HQLAx as one example. “We are seeing business cases coming up, where you could basket the collateral and move it on the same day rather than wait for the next day.”

The underlying format matters

So, who will be directly affected when assets get tokenized or fully digital, and money gets on blockchains in different forms? At first glance, the shift may not make a huge difference to an asset owner or asset manager, as long as their custodians and system providers offer interfaces to the platforms and can present portfolios and markets in well-consolidated overviews. After all, on the balance sheet line for total assets, a dollar is a dollar, right?

Not so fast.

“Yes, the custody banks are offering a single interface point to make it easy for the buy-side firms to adopt the DLT related services. But going a little deeper into it, the asset manager will always want to be able to know ‘where are my assets right now?’”

FACT BOX

Three forms of assets, four forms of cash

“These boxes highlight the movements of securities and cash in different forms,” says Vinod Jain about his matrix.

When securities are traded, we are accustomed to thinking in terms of a “DvP”, with D for delivery, of a securitised asset, and P for payment, of money. With DLT, new formats, of both assets and money, make it necessary to pinpoint which form of asset is delivered, versus which form of money is paid. In Vinod Jain’s view, this is the step that every discussion about a DLT solution must begin with, or confusion is bound to follow.

The security can take two new forms beside the standard one: tokenised or native-digital. The means of payment, meanwhile, can take three new forms beside traditional cash: wholesale central-bank digital currency (CBDC), stablecoins, or cryptocurrency. With three forms of assets, multiplied by four forms of payment, we get a matrix with twelve cross-sections representing the specific DvP models, which will each require its own form of infrastructure.

Bottlenecks increasingly in focus

While industry discussions some years ago were very much around proofs of concept for standalone DLT solutions – often showing it worked – the focus lately has been on how to agree on standards for how to connect solutions to each other. This is where traditional finance, with all its imperfections, has a head start since decades or centuries.

In the graph, orange-coloured pipes connect all the boxes – illustrating that to compete with traditional solutions, the new DLT facilities will need connectivity with the ones at all the other cross-sections. Let’s say a custodian builds capabilities to manage cryptocurrency for institutional-investor clients. Will that custodian be ready to onboard a new client who deals only with crypto and fully digital assets, or will there be a disconnection that hampers the onboarding process?