New trading mechanisms start to blur the line between exchange and OTC trading as challenges surround delivery-versus-payment (DvP) mechanisms.

The volatility of digital assets and cryptocurrencies is a given, but adding more complexity and risk in terms of market structure will only further impede participation by a broader set of institutional investors. A closer look at the custody and OTC models being utilized and the challenges surrounding delivery-versus-payment (DvP) mechanisms reveals that as the crypto market evolves, so, too, are solutions to address the thorniest issues.

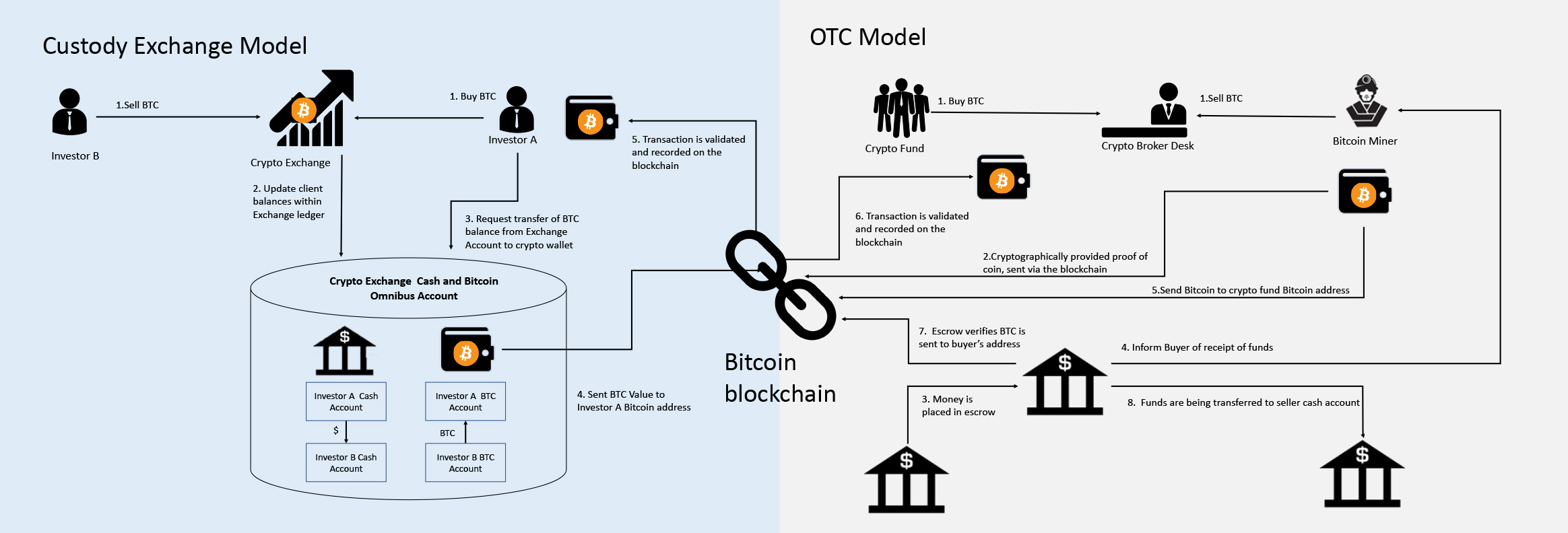

Centralized Exchange Model

The centralized exchange model is the dominant approach for trading digital assets and cryptocurrencies in public blockchains because it solves the limitation of numerous blockchain protocols relating to trading speed and settlement fees. (Mining fees are per transaction rather than the traded value.) However, this poses significant issues for the market in that parties to a trade are exposed to the security of the crypto exchange during the transaction process. As a result, there is growing skepticism about the relevance of the centralized exchange model, and most institutional participants are utilizing OTC mechanisms to facilitate trading and settlement of crypto assets.

(Source: Opimas analysis)

OTC vs. Exchange Transactions

The reasons for institutional investors to trade OTC versus on exchange are often similar across assets, but they tend to be reinforced in the crypto-world:

- Market Impact: The fragmentation of liquidity across crypto exchanges poses significant challenges for investors who want to limit market impact when executing large orders. OTC is therefore an option to address this issue. Notably when executing block trades that are less sensitive to the blockchain settlement price, (mining cost) but much more to the risk incurred by trading on a centralized exchange. Some FinTechs are also answering this need by developing technological offerings that specifically address this issue, including some that provide smart order routing systems.

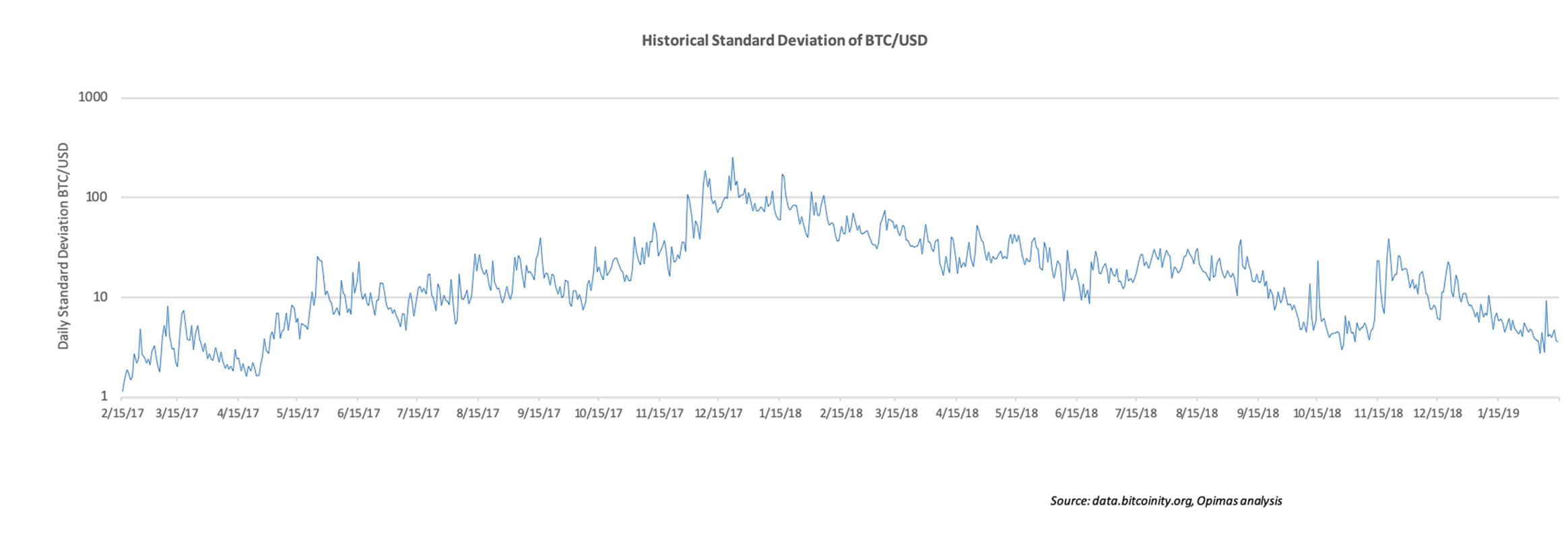

- Negotiation: Cryptocurrencies are an emerging asset class and therefore a market that experiences high volatility. For example, Bitcoin reached an all-time high on December 22, 2017 when it peaked at 255.61 vs. the USD and its lowest on February 15, 2019 at 1.12% (see figure below). Such market conditions reinforce the value of price negotiations that can occur OTC.

(Source: Opimas analysis)

- Potential Credit Intermediation: One key challenge in the digital asset infrastructure is the lack of a DvP mechanism to guarantee the completion of the second leg of any transaction. The issue is not limited to the interaction between the blockchain and banking infrastructures, but also between the various blockchain infrastructures. Therefore, the credit intermediation that could be provided by OTC brokers is all the more relevant.

A New Model of Exchanges?

A number of crypto startups admit that the centralized model of crypto-exchanges was a necessary first step to develop the market, but that the next evolution will come from decentralized exchanges. While this type of venue currently represents trivial volumes, it is gaining significant attention and might represent the next evolution and/or addition in the cryptocurrency exchange landscape. For example, Binance, which operates a centralized pure crypto exchange, last summer unveiled a demo of its decentralized exchange (DEX) platform. But even within the decentralized exchange space, some differences arise. One needs to think of them as P2P platforms. On one hand, you have semi-decentralized venues that aggregate orders into a centralized order book (think Napster), but in which settlement is decentralized. On the other hand, there are fully decentralized platforms, like Gnutella, in which the user reconstructs the order book on its interface by aggregating orders available in the network and where queries are distributed by all the other nodes on the network. These new trading mechanisms would certainly blur the line between exchange and OTC trading.

This article is part of a three-part series, authored by Tom Casteleyn, Global Head of Custody Product Management, BNY Mellon Asset Servicing, and Lucien Foster, Head of Digital Partnerships, BNY Mellon, that explores the technological play in the cryptocurrencies market.

1) Average Median standard deviation of daily returns of BTC/USD pairs across crypto-exchanges: Bit-x, Bitfinex, cex.io, Coinbase, exmo, Gemini, Kraken