Paying $3.2 billion, and assuming up to $5.4 billion in losses, fellow Swiss bank UBS takes over ailing Credit Suisse. Sunday’s deal, supported by a massive Swiss guarantee, was welcomed by representatives of the global finance community such as the US, EU, and British central banks. However, $17 billions in bonds is written down to zero.

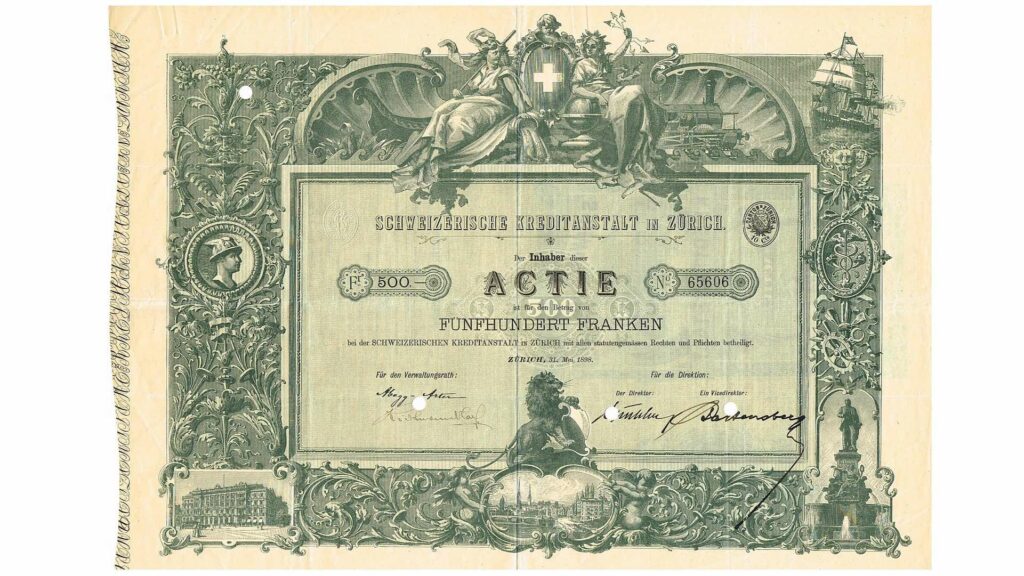

This Reuters summary relates that “[p]ressure on UBS helped seal Sunday’s deal”. UBS CEO Ralph Hamers acknowledged that much remains to be detailed. Founded in 1856, Credit Suisse sees the end of its journey after over a decade of decreasing share value, including tax evasion scandals, a tough blow from losses in the Archegos failure, and most recently a final push of seeming contagion from the downfalls of US banks Silicon Valley Bank, Signature Bank, and Silvergate Bank.

Find here the press releases from, respectively, UBS and Credit Suisse.

Reuters also notes that “[t]he Swiss regulator decided that Credit Suisse bonds with a notional value of $17 billion will be valued at zero, angering some of the holders of the debt who thought they would be better protected than shareholders in a rescue deal announced on Sunday”. On this topic, the news agency carries this separate article.