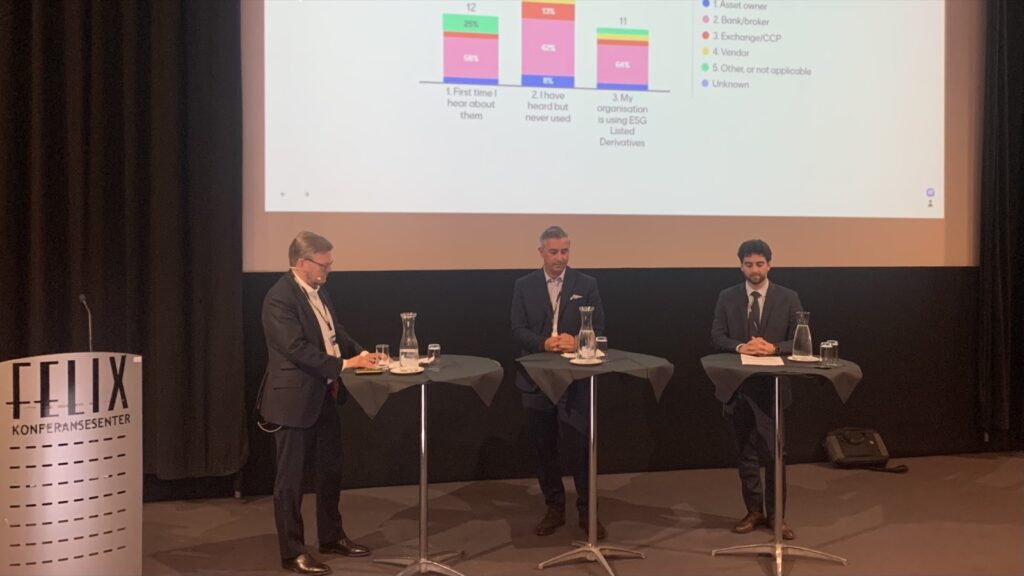

VIDEO | Three quarters of the audience at PostTrade 360° Oslo had heard about ESG listed derivatives, but less than one quarter had used those themselves. A panel looked into how ESG derivatives are being used and regulated.

Eurex and BNP Paribas were both among the event’s sponsors.

One challenge when ESG ratings are brought into investment value calculations, for example via an index, is that they tend to generate so called tracking errors towards the traditional benchmarks. The bigger the ESG emphasis, the harder it gets to follow the tracking index closely.

Panellists were …

Davide Masi, VP Product Manager, Fixed Income ETD Product Design, Eurex,

Achim Karle, Sales EMEA, ESG Derivatives, Eurex, and, as moderator,

Juha Sternberg, Senior Business Development Manager, Nordic Region Derivatives Execution and Clearing, BNP Paribas

When corporations get into legal controversies across the world, or tend to publish their financial reporting too late, these might be signs you should pull out your investments from them. In terms of ESG, this files under the G – governance. Beside the environment, the E, many find the other two ESG letters less intuitive, particularly the G. But when companies are poorly governed, it is likely to reflect in the financial performance sooner or later, and indicators are often there before it happens.

Watch the session video here!

First, log in (or register as a user): LoginUse your LinkedIn login if you like.

• News around PostTrade 360° Oslo 2023, on 31 May, is gathered here.

• The conference info site, with detailed agenda, is here.

• For post-event access to recorded sessions, sign up here (where you can even log in easily by your LinkedIn account).

• By the way … are we connected on LinkedIn already, among the 3,100 post-trade pros who are? Follow us here.