EU securities authority ESMA has added the European Market Infrastructure Regulation to its “Interactive Single Rulebook”.

Essentially a set of web pages – where the top-level regulation text is garnished with links to related level-2 and level-3 regulation – the Single Rulebook is meant to consolidate the overview of rules that apply to each subtopic. You find the rulebook here.

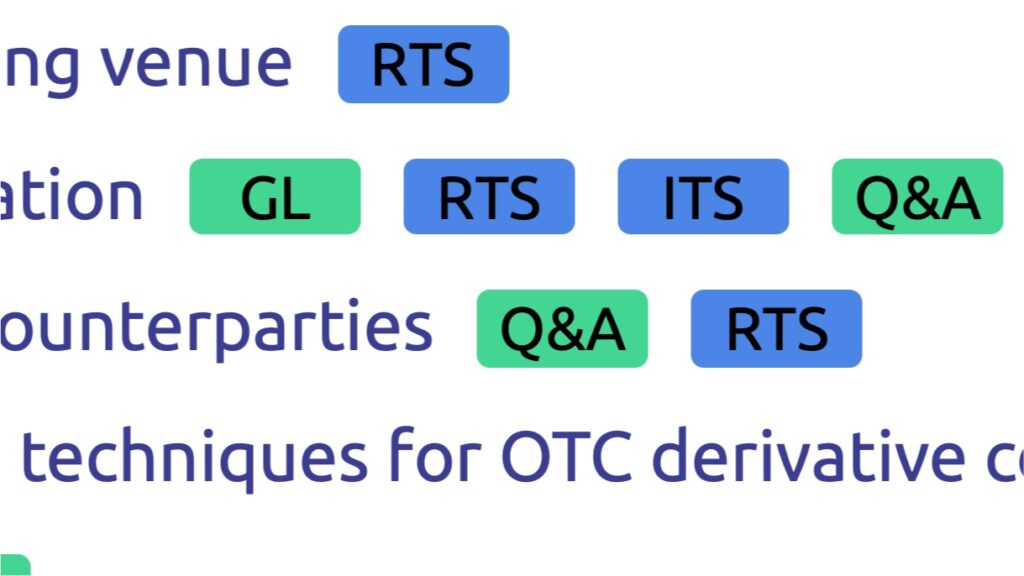

The links may lead to Implementing Acts (“IA”) or Delegated Acts (“DA”) by the European Commission (including “RTS” or “ITS” technical standards developed by ESMA and adopted by the Commission), or to Guidelines (“GL”), Opinions (“OP”) and Q&As (“Q&As”) issued by ESMA.

In total, the regulations now contained in the Single Rulebook are SFTR, CSDR, Transparency Directive, Prospectus Regulation, UCITS, EMIR, Benchmarks Regulation, CRAR, MiFIR and MiFID II.

The “levels” refer to the financial regulatory process that was lined out by Alexandre Lamfalussy in 2001, where level 1 is regulation by European Council and Parliament, level 2 is detail added by the European Commission, and level 3 is detail added by three sub-authorities, including ESMA. There is also a level 4, relating to national market-supervisory authorities and the initiatives by on EU level to harmonise their practices.