On February 12, 2014, the obligation to report derivatives trades to trade repositories came into force under the EMIR regulation. It also happened to be the first day of business for the KDPW Trade Repository (KDPW TR). Later, on July 13, 2020, following the introduction of the SFTR regulation, the reporting obligation was extended additionally to cover securities financing transactions. Learn more about the repository’s 2-billion-trade journey – and the contribution it brings in the market.

On the day the KDPW Trade Repository first opened for business, 267,000 reports were submitted, in relation to over 112,000 trades. The record holder sent in over 69,000 reports.

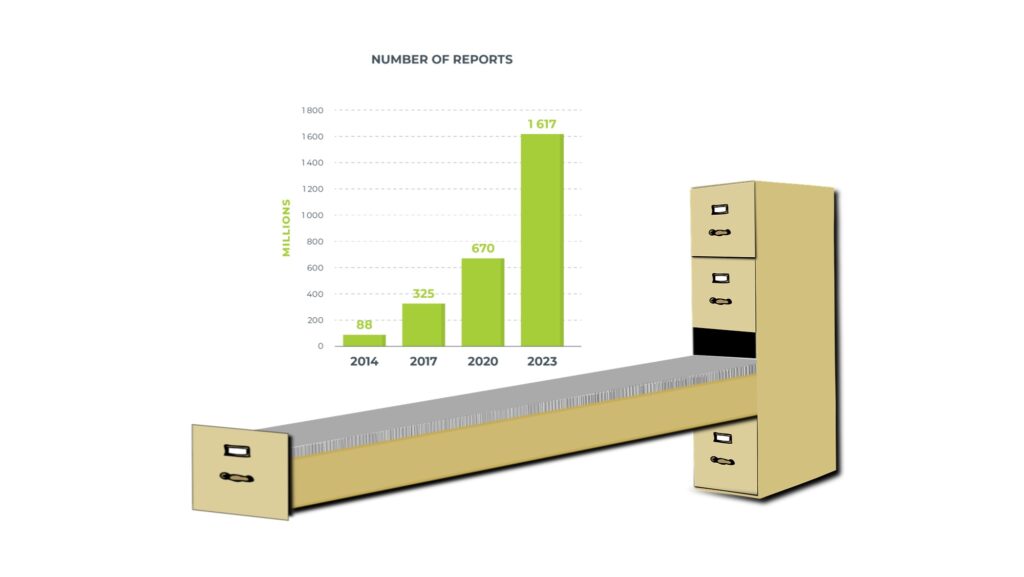

Over the course of 10 years, KDPW TR has received 6.6 billion reports relating to 2 billion trades.

A decade ago, KDPW TR started with 73 participants. There are currently 280 participants in the KDPW Trade Repository, including 40 foreign members.

KDPW TR is part of the KDPW Group, which has 30 years of proven experience providing post-trade services for the capital market in Poland – central Europe’s biggest economy – and throughout the EU.

Preparations for the launch of the trade repository lasted several months, in order to meet all the formal, legal and technological requirements set out in EU regulations.

KDPW TR was one of the first trade repositories in Europe to be registered by ESMA in November 2013. KDPW is also authorised by ESMA as an EU trade repository under SFTR and by the Polish Financial Supervision Authority as an approved reporting mechanism (ARM) under MiFID2/MiFIR.

Close to the participant

What makes KDPW different from other trade repositories? First of all – our customer approach. We are the smallest of the three trade repositories currently operating in the EU, which allows us to reach out to each of our participants on an individual basis and respond quickly to any questions or needs our clients may have. Another advantage of using our services are fair and partner-based principles of cooperation – we do not require a minimum contract period, or have any volume threshold requirements for reported trades for clients to join.

It’s especially important now, during the implementation of system upgrades related to EMIR Refit, to provide access to a testing environment that is free of charge and available 24/7, where our participants can count on the support of our experts. KDPW TR has been using XML messages in its reporting solutions since its launch. The new regulatory requirement set out in EMIR Refit only now makes this standard mandatory. This is an added convenience for our clients, who have had time to familiarise themselves with the new reporting technical standards.

Our fees are also remarkably attractive.

We also provide a friendly porting procedure, for clients who wish to transfer from their legacy trade repository to KDPW TR.

For more information about our services and how we can help you meet your reporting obligations, please visit us at: https://www.trplus.kdpw.pl/