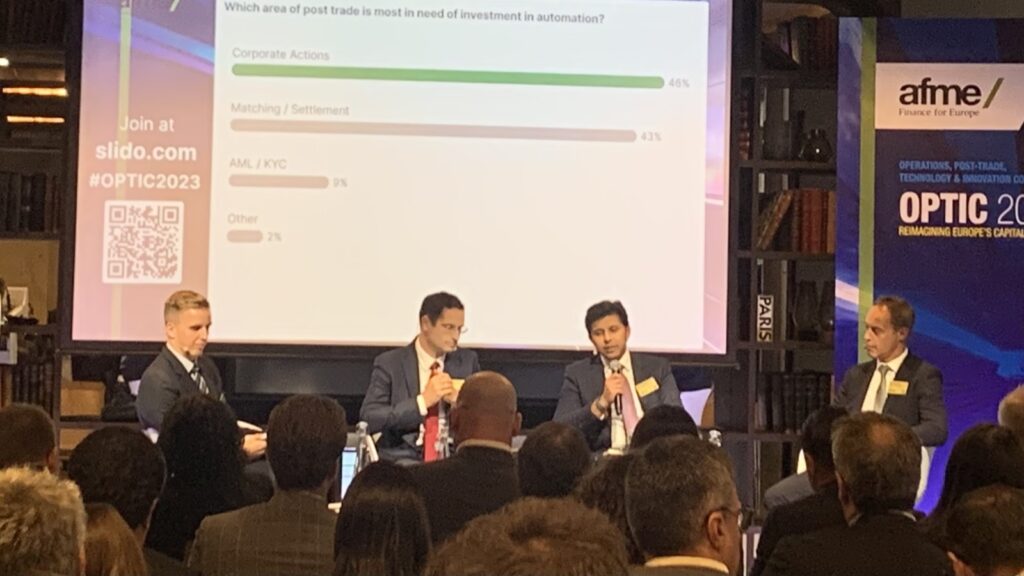

Corporate actions will be the best investment case for automation in the next years – if an audience vote at AFME’s operations conference Optic on Tuesday is to go by.

Corporate actions got a 50-percent score when the audience was asked “Which area of post trade is most in need of investment in automation?”. Matching / Settlement came in second, with 39 percent of the votes, while AML / KYC raised few votes in comparison.

The automation panel, moderated by AFME’s post trade and prime services director Peter Tomlinson, hosted speakers …

John Worden, Head of Custody & Post Trade Strategy, UBS,

Karan Kapoor, Global Head of Regulatory Consulting, Delta Capita, and

Remi Lagane, Senior Post Trade Processing Expert, Murex.

An anonymous delegate asked what would drive banks and others to actually invest in post trade technology. The panel appeared to agree that regulation has an important role to play in areas where coordination is necessary, once the industry has been able to agree on which path to go.

Some discussion was raised on the value for firms in seeking competitive advantages from going alone on investments, versus benefits from cross-industry efficiencies in coordinated investment areas. Karan Kapoor weighed in clearly for the coordinated investments, saying “collaboration is key now”, while Remi Lagane suggested seeking benefits on both fronts.

The yearly Optic conference, in Brussels on 17–18 October 2023, is hosted by the Association for Financial Markets in Europe (AFME). Optic stands for the “Operations, post trade, technology and innovation conference”. PostTrade 360° is there, with our coverage collected here.